February Newsletter

Get your copy of the February newsletter by clicking here!

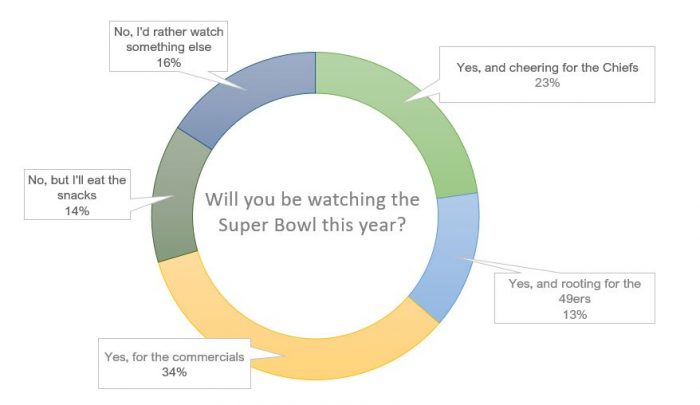

Before you take this month’s poll, here’s the results from the January poll:

February 2020 Newsletter Challenge

Click Start Challenge to begin.

Get your copy of the February newsletter by clicking here!

Before you take this month’s poll, here’s the results from the January poll:

Click Start Challenge to begin.

Get your copy of the January newsletter by clicking here!

Review previous newsletters by clicking on the Newsletters category on the VDMC.net home page, or by following this link. (Note for point-seekers: there are challenges available on previous posts!)

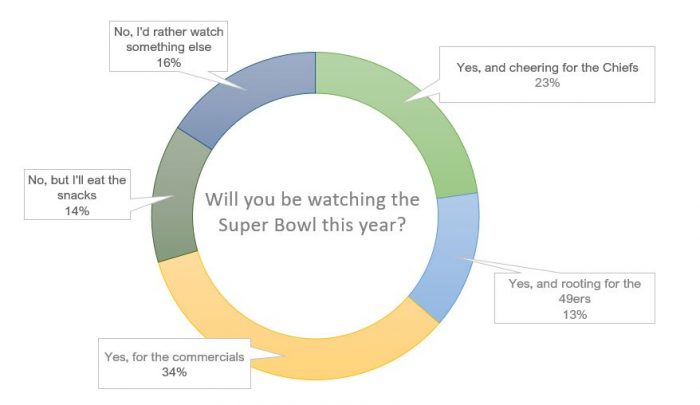

Before you take the January poll, here are the results from December:

Get your copy of the December newsletter by clicking here!

Review previous newsletters by clicking on the Newsletters category on the VDMC.net home page, or by following this link. (Note for point-seekers: there are challenges available on previous posts!)

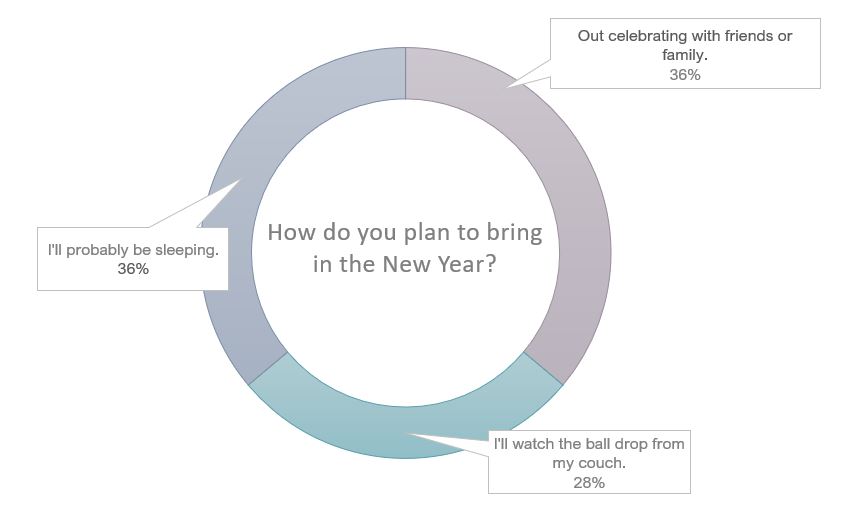

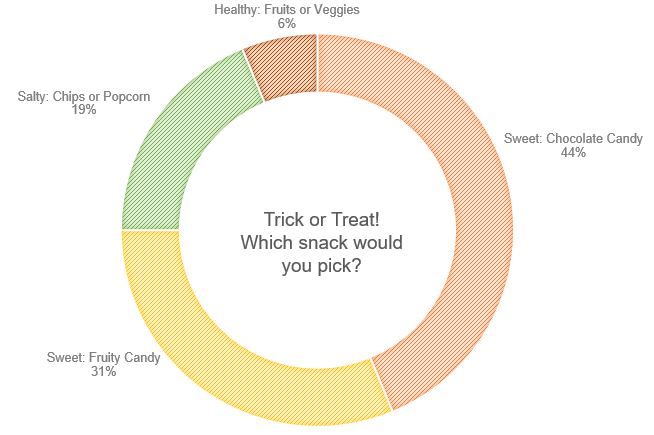

Before you take the December poll, here are the results from November:

Before you read any further, I want to preface with the fact that this is an opinion, MY OPINION, and the intention of it is to help you form an opinion. I don’t have a crystal ball, no direct line to Mr. Powell or Mr. Trump, no insider info, and no magic tweeting power (looking at you Trump) or even know how to tweet. I can’t tell you what is going to happen in 2020 with rates. However, I can tell you what happened in 2019, and what the current expectations are for 2020 in hopes that you can make more informed decisions, and have more educated conversations with your borrowers and realtor relationships.

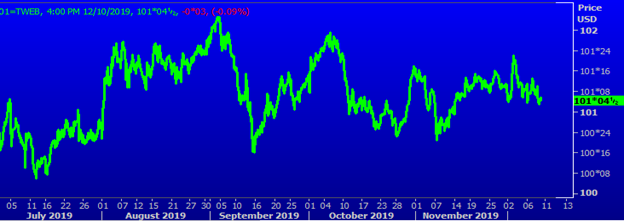

Below is a chart of the UMBS market 3 Coupon from 01/01/2019-12/10/2019. As the chart below shows, we have seen a trend of higher UMBS prices which translates to lower interest rates. We started the year about 4pts lower on the UMBS 3 coupon market than we sit today. 4pts equates to roughly .625-1.00% in lower rates than we were quoting in January. This was a pretty gradual rally that didn’t hit its real strides until the end of Q2.

Since 7/2, we have been hovering in a really nice resistance band on the UMBS market. The low was reached on 9/13 at 100*17 and the high was reached on 9/4 at 102*04. Outside of the high and lows, we have been mostly in the range of 100*24 and 101*16. While that is a 24/32nds difference, it has allowed for some stability in the market. We have seen the ups and downs as usual, but the last 6 months or so have been really resistant to move to much higher rates or much lower rates.

Fed Changes Course

If you review my 2018 EOY commentary, it was widely expected that 2019 would see rates in the 5s with the FED continuing to increase the Fed funds rate. In a reversal of course, the Fed actually began reducing the fed funds rate effective on 7/31 and proceeded to reduce 2 more times throughout 2019.

The Fed cautioned against a slowing global economy along with global trade tensions as a primary reason for their reversal. They proceeded to state that domestic data remained strong and the idea of the economic expansion period in the US ending was not an immediate risk.

As expected, the Federal Reserve left rates unchanged on 12/12/19, stating that depending on major global developments or substantial shifts in inflation, it will remain on hold. The general consensus from the Fed seems to be that they will leave the funds rate alone through 2020 unless something major happens domestically or abroad. In Fed Chair Powell’s statement, he made it sound as if the Fed is going to keep the funds rate low a little longer to keep inflation higher to maintain a strong economy.

Don’t Call it a Comeback – Refinances

Just when everyone thought the refinance boom was over, the market took a 180 turn and decided to toss the industry a bone. Most loans closed in 2018-early 2019 quickly became eligible for a refinance with the rally we saw to start 2019. There were several companies on the verge of acquisition or closure that quickly realized an opportunity and pounced. Several branches here capitalized as well and saw a production increase due to past clients.

While we are a purchase-centric company and never want to take our eyes off our bread and butter, we do realize that our past clients will be solicited whether it is by us or someone else. Should you have excess capacity or want to supplement a pipeline that is struggling with the slower months, this may be an opportunity. If you want us to scrub your pipeline for possible refi leads, please let me know. I will gladly run a pipeline report for you.

Interest rate outlook

I don’t have a crystal ball to predict what rates will do in 2020 – if I did, I probably wouldn’t be writing this commentary. I can say that the FED turned Dovish in 2019 and I do not see that changing back to Hawkish any time in 2020. The FED has made it pretty clear they are taking both the global economy and trade tensions into consideration. Until we start to see stronger data from the Global economy and eased trade tensions, I don’t see the FED moving off their Dovish stance.

I think 2020 will remain a very strong interest rate environment. What does very strong mean? Likely in the 4s for most of 2020. The FED seems to be in a holding pattern in terms of their economic policy, and unless something major happens on the global stage or domestically, they appear to be riding their current policy through November’s election.

Have the locking conversation early and often with your borrowers. While we have been operating with some pretty concrete upper and lower bounds on the UMBS market, we are still seeing the swaying between the bounds. We feel there is much more downside risk in the current rate market than there is upside risk. One day, trade talks may come out positive causing the market to react negatively, and one week later we could have the complete opposite happen. Could a rally into the mid to low 3s happen, sure, but so could a quick turn into the high 4s or even 5s. We don’t have a way to protect against the downside risk, we do however have a way to protect against the upside risk – that being the renegotiation policy after locking. While it is only to be used to save a deal, if push comes to shove it should allow you to keep a borrower happy if rates improve drastically.

Election year

One thing to keep on the back burner is that 2020 is an election year. Election years tend to be relatively quiet in terms of sweeping policy changes. The FED will also likely try to skate through the election year without pushing too many economic buttons unless completely necessary. As election time comes, it will be important to have the lock button near. When President Trump was elected, we saw some very drastic market swings. You can likely expect the same if we see a change to a Democrat elected.

Opportunities

The market handed us a nice rate environment to end 2019. It is on us as a company and industry to capitalize on this while it lasts. No one can predict how long this low rate environment will be around. If we take advantage, we all should have an extremely successful start to 2020.

To 2020

I truly believe this is a year to take advantage of the still historically low rates. We are expecting to see a strong purchase market, and refinance opportunities will be there to supplement as well. We have so many great tools at our disposal here at VanDyk – I believe we are well positioned to seize the opportunity that 2020 is providing us.

I hope everyone has a Happy New Year. Looking forward to a strong and successful 2020.

Brad Chatel

Secondary Manager

We are happy to announce that we have signed up with ACC Mortgage as a broker outlet to offer more non-QM options. ACC offers many non-QM options along with ITIN, Foreign Nation and some higher LTV Jumbo options.

ACC does not cover our entire lending footprint. Eligible states include: AZ, CA, CO, CT, DE, DC, FL,GA, IL, IN, KS, MD, MI, MN, NC, NJ, NV, OR, PA, SC, TN, TX, UT, VA, & WA. Please be on a lookout for an email from our account rep for training calls. He is planning to do a couple calls to help get everyone up to speed and to answer any questions you may have.

For additional questions about process, products, and rates, please contact our account rep:

Brendan Sjodin

National Account Executive

M: (507) 339-3614

brendan.sjodin@accmortgage.com

We are happy to announce that we have signed up with SpringEQ as a broker outlet to offer Piggyback and stand-alone HELOC loans. They offer up to 100% standalone HELOCs and up to 95% piggyback 2nds. Unlike TCF and other second outlets that we have agreements with, SpringEQ is actually paying a broker compensation of 2%. We no longer have to refer out second mortgages and can now broker them.

SpringEQ covers almost our entire lending footprint except for AK, HI, ID, MA, MO, ND, NV, NY, SD, UT, WV, and WY. Please be on a lookout for an email from our account rep for training calls. She is planning to do a couple calls to help get everyone up to speed and to answer any questions you may have. For additional questions about process, products, and rates please contact our account rep below. Kristen is very responsive and has been great to work with during the application process.

Kristen Faidley

Senior Account Executive – Spring EQ

Phone: 952-200-9836

Kfaidley@springeq.com

www.wholesale.springeq.com

IMPORTANT NOTE: Closings between 11/22 and 12/5 will be impacted as follows:

Get your copy of the November newsletter by clicking here!

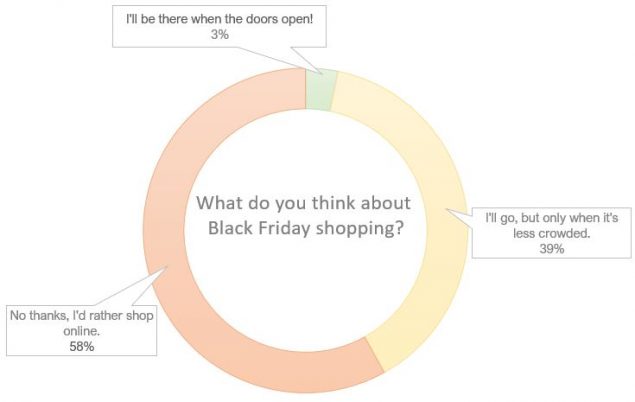

Before you take the November poll, here are the results from October:

The open enrollment period to elect your benefits for the 2020 plan year via Paylocity begins on November 11 and ends on November 22. Even though you may not be electing coverage through the company, you will still need to login to Paylocity and waive your benefits.

The following documents are available:

Listed below are the general session date/times, location and link to webinar.

Once open enrollment begins, the benefit summaries of each plan will also available for viewing on the enrollment platform within Paylocity.

Grand Rapids Corporate Office

Monday, November 11, 2019 | 11:00am EST or 2:00pm EST

Upper Floor Conference Room

GoTo Live Webinar

Monday, November 11, 2019 | Live Session: 4:00-4:45pm EST

Presenter: Karen Barnes, Client Executive, Hylant

Recorded Webinar

Monday, November 11, 2019

*Link to recorded webinar will be provided immediately following the live webinar session.

Should you have questions, please contact Sarah Shilling at sshilling@vandykmortgage.com.

Below you will find our 2020 schedule for payroll timeframes and pay dates. Should there be any questions please email payroll@vandykmortgage.com.