Loans closing on Weds 1/2 and Thurs 1/3 files need to be TRID Ready by 12/27 with a CD disclosed on 12/28.

Loans closing Fri 1/4 need to be TRID Ready by 12/28 with a CD disclosed on 12/31

Loans closing on Weds 1/2 and Thurs 1/3 files need to be TRID Ready by 12/27 with a CD disclosed on 12/28.

Loans closing Fri 1/4 need to be TRID Ready by 12/28 with a CD disclosed on 12/31

FHA INFO #18-52

December 26, 2018

NEWS AND UPDATES

FHA Single Family Housing Operations and Systems Availability During Government Shutdown

As a result of the Federal Government shutdown due to a lapse in appropriations, until further notice the Federal Housing Administration’s (FHA) Office of Single Family Housing and its mortgage insurance program will be operating with limited services. As was the case in previous shutdowns, under a lapse in funding, FHA’s actions and decisions about which operations continue, or not, are governed by the Constitution, statutory provisions, court opinions, and Department of Justice (DOJ) Opinions, which provide the legal framework for how funding gaps and shutdowns have occurred in recent decades.

While some services will continue to be operational, please note that across the board, the services that remain available during the shutdown will have significant impacts to customer service and/or limited functionality.

Please see the information below for an overview of the business impacts specific to the Office of Single Family Housing and its Single Family mortgagees, Title I lenders, and other stakeholders in FHA single family transactions. Full descriptions and details can be found in the Department of Housing and Urban Development’s (HUD) Contingency Plan for Possible Lapse in Appropriations document posted on HUD.gov.

The FHA Resource Center’s online FAQ site has been updated to include additional information about operations and systems availability during the shutdown (keyword “shutdown”).

Customer Service

The following will be available for general inquiries during the shutdown, but with limited staff assistance available, longer wait times for assistance, and limited ability to answer case-specific questions:

Insurance Endorsements

Lender Certification, Monitoring, and Quality Assurance Processes

The following process will be available during the shutdown, but with limited staff assistance available, and longer wait times for assistance:

The following processes will be unavailable for the duration of the shutdown:

Other Participants in FHA Transactions

The following processes will be available during the shutdown, but with limited staff assistance available and longer wait times for assistance:

The following processes will be unavailable for the duration of the shutdown:

Pre-Endorsement Loan Processes

The following pre-endorsement loan processes will be available during the shutdown, but with limited staff assistance available and longer wait times for assistance:

The following processes will be unavailable for the duration of the shutdown:

Servicing, Claims, and Asset Management

The following servicing, claims, and asset management business processes will be available during the shutdown, but with limited staff assistance available and longer wait times for assistance:

The following processes will be unavailable for the duration of the shutdown:

Technology Systems

The following systems will be available for use, but with limited capability for actions that require FHA staff intervention:

The following FHA system will be unavailable for the duration of the shutdown:

Training, Events, and Conference Presence

FHA will be unable to host any live or real-time web-based training events scheduled during the shutdown. Pre-recorded webinars will remain available on the Single Family Self-Paced, Pre-Recorded Training web page on HUD.gov, but will not be updated for the duration of the shutdown. Further, FHA staff scheduled to present at, or registered to attend conferences and other events, will be unable to do so for the duration of the shutdown.

Quick Links

Resources

Contact the FHA Resource Center:

| FHA INFO Archives: | Visit the FHA INFO Archives to access FHA INFO messages issued from 2012 to the present. | |

| Subscribe/Unsubscribe

Instructions: |

To subscribe to the Single Family FHA INFO mailing list you can use this link:FHA INFO or send a request by email to: answers@hud.gov Bulk subscriptions: To sign up your entire office or a large group, send the list of email addresses (in the format below) to: answers@hud.gov aaa@xyz.com bbb@xyz.com ccc@xyz.comTo Unsubscribe follow the unsubscribe instructions on that page. |

|

| Resource Links: | FHA Archived Webinars | Foreclosure Assistance |

| Career Opportunities | Grant Opportunities | |

| Contracting Opportunities | HUD Homes – Property Listings | |

| Events & Training | HUD.gov | |

| FHA Forms | Making Home Affordable | |

| FHA Homeownership Centers | Presidentially-Declared Major Disaster Areas | |

| FHA Mortgagee Letters | Visit our Single Family Home Page | |

We hope that you will want to continue receiving information from HUD.

We safeguard our lists and do not rent, sell, or permit the use of our lists by others, at any time, for any reason.

Connect with HUD on Social Media and follow Secretary Carson on Twitter and Facebook.

As you may know, the current government budget has been funded through midnight of Friday, December 21st, 2018. If new funding is not made available, the government could experience a shutdown.

In the event of a government shutdown on December 22, the IRS will cease all operations. You may continue to submit 4506-T requests and we will continue to process those as normal; however, transcripts will not be available until the government resumes operations.

If you have any questions or concerns, please contact DataVerify Customer Support and we will be happy to assist you.

Thank you,

Customer Support

DataVerify

(p) 866.895.3282

Support@dataverify.com

www.dataverify.com

For loans closing on 12/26 – 12/28, files need to be TRID Ready by 12/20 with a CD disclosed on 12/21. Loans closing 12/31 need to be TRID Ready by 12/26 with a CD disclosed on 12/27

Due to the upcoming Christmas Day holiday, the IRS will be closed on Tuesday, December 25th. DataVerify will also be closed and will process requests in the order in which they are received on Wednesday, December 26th.

If you have any questions or concerns please contact DataVerify Customer Support and we will be happy to assist you.

Thank you,

Customer Support

DataVerify

(p) 866.895.3282

Support@dataverify.com

www.dataverify.com

Hello Everyone,

As a reminder all disclosure requests for Initials and Redisclosures must be sent through LE Page 0 (Initials) and LE Page 4 (Redisclosures). Compliance is no longer accepting emailed requests at Compliance@vandykmortgage.com and will push any requests received back to the sender.

Please see the attached PDF and the link below for training on how to submit requests using LE 0 & 4.

https://vandykmortgage.ispringlearn.com/organization/1/view/23992-YfbdB-XgqEW-41C7U

Thank you to all those who are currently using this system and please let me know if you have any questions.

Thanks

RETIREMENT PLAN PARTICIPANTS

On December 2, 2018, Transamerica implemented increased website security features on all accounts. We are improving security for our clients and you will be asked to verify and update your personal information and other account details as part of these enhancements.

In order to access your retirement account, you will need to register as a new user, if you have not done so already.

Register Here

Once you have completed the registration process, you can visit www.transamerica.com to access your account.

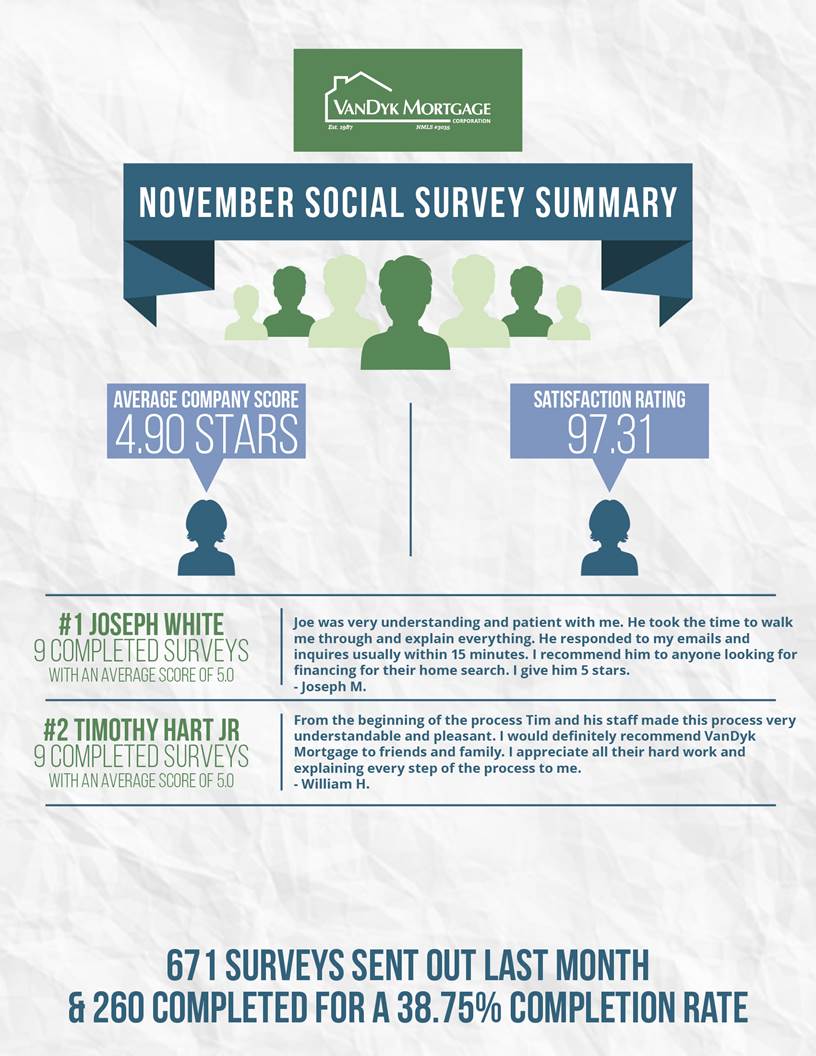

Congratulations to Joe White & Tim Hart for being the Top Social Survey users in November 2018!

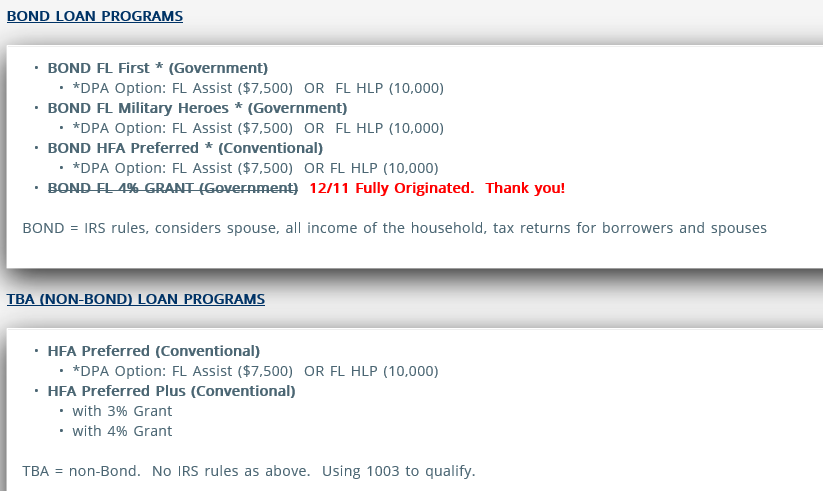

Florida Housing Bond Program Grant Update 12/12/18

Florida Housing announced this morning that the Bond Grant loan option has been fully utilized. Florida Housing STILL has the Florida Assist Second Mortgage, FL HLP Second Mortgage and the TBA Program Grant (3% or 4%) down payment assistance options available. Below is a snap shot of the available programs and the DPA options available.