Dear Staff,

Have you wondered whether the H.S.A. could be a good option for you?

Please open the “Did You Know” link below and learn more about how you may benefit from electing this plan.

Thank you!

Dear Staff,

Have you wondered whether the H.S.A. could be a good option for you?

Please open the “Did You Know” link below and learn more about how you may benefit from electing this plan.

Thank you!

Have specific questions regarding your benefits and would like to speak to an expert?

Please open the “Did You Know” PowerPoint attached.

Thank you!

Margarita Hays

On the evening of November 28th Optimal Blue will be pushing through a major update/release. To make sure that the release functions properly we will be shutting down the ability to lock loans at 5pm EST on 11/28. Lock ability will be reinstated at 11am EST on 11/29. We apologize for any inconvenience this may cause. Please prepare accordingly as no exceptions will be made to this.

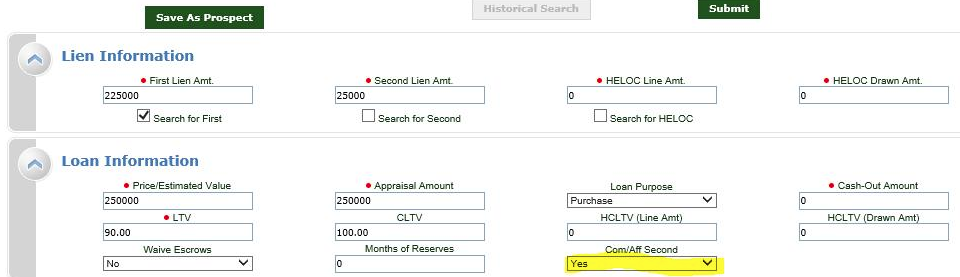

Optimal Blue: Community Seconds

Over the weekend Optimal Blue released an update to help better price loans with Community Seconds. If a loan has a community second down payment it does not have CLTV pricing hits (assuming the whole second lien is from the community second). Prior to this release you were required to remove the second lien information when pricing a loan with a community second. With this release a drop-down selection is now present when a second lien loan amount is pulled in from encompass. If you are utilizing a community second down payment you will want to change the highlighted drop down below from “No” to “Yes” to view correct pricing.

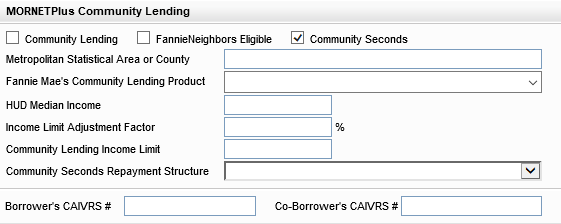

Within Encompass please make sure that you have the Community Seconds check box marked on the FNMA Streamlined 1003 as Secondary will be checking this to make sure that the drop down wasn’t selected in error.

Please email secondary@vandykmortgage.com should you have any questions

Dear Staff,

If you missed the Open Enrollment Webinar today, you can still capture the information by clicking on the link and following the instructions below.

https://vdmc.net/dept/hr/fileshare.php

Instructions: Click “Benefits”, then “Benefits”, then click on the file titled “VanDyk Open Enrollment Meeting for 2019”.

Thank you!

Margarita

Service Interruption message follows:

Ellie Mae is having Document management errors again. SOAP EXCEPTION Errors. They are investigating.

Dear Employees,

Open Enrollment begins TODAY!

Here are a few helpful items to share with you…

General Information Session Locations:

| Clearwater, FL

Thursday, November 15, 2018 First Floor Conf. Rm – Feather Sound Building One Presenter: Karen Barnes, Hylant

|

|||

| Sessions: | 10am | 1:30pm | 3pm |

| Grand Rapids, MI

Thursday, November 15, 2018 Upper Floor Conference Room Presenter: Gina Rogers, Hylant

|

|||

| Sessions: | 10am | 1:30pm | 3pm |

| Live Webinar

Presenter: Karen Barnes, Hylant Friday, November 16, 2018 Link to webinar: Please join my meeting from your computer, tablet or smartphone. https://global.gotomeeting.com/join/202926781 You can also dial in using your phone.

|

|

| Session: | 9am EST – Live |

| Recording: Information to access recorded webinar will be provided at a later date. | |

Please contact me at mhays@vandymortgage.com or Brenna Toland at btoland@vandykmortgage.com should you have questions.

Regards,

Margarita Hays

Good Morning Staff,

Several questions have been posed regarding Open Enrollment. Perhaps this may answer some of your questions as well.

Q: When does Open Enrollment begin?

A: Open Enrollment begins TOMORROW, Thursday, Nov 15. Sessions in FL and MI begin at the following times:

Q: Do I have to enroll or will benefits roll over?

A: Everyone will need to re-enroll. All benefits end on 12/31/18.

Q: I don’t plan on using VanDyk’s benefits this year. Do I still need to enroll?

A: YES! Even though you do not plan to use VDM’s health benefits, you will need to go through the enrollment process and WAIVE the benefits.

Q: When will Open Enrollment end?

A: Open Enrollment will end on November 29.

Q: Can I make changes to my elections after Open Enrollment ends?

A: Unfortunately, no. Once open enrollment ends the data will be sent to the insurance carriers.

Q: If after making my elections I need to make a change, can I still do so during the Open Enrollment period?

A: Yes. You can make a change if open enrollment has not ended.

Q: How can I access the recorded webinar?

A: We will provide that information after the live webinar has ended.

Q: Will we receive information on the various plans?

A: Please see attached document.

Q: Where can I find detailed information (Summary Plan Documents) regarding the different plans?

A: Detailed information regarding the different plans can be found in 3 locations:

Q: How do I elect my benefits online?

A: We have provided step-by-step instructions on electing your benefits online. Please see attached.

Q: What if I don’t have my credentials for Paylocity?

A: Contact HR@vandykmortgage.com and we will reset your password.

Q: When will my new benefits become effective?

A: January 1, 2018.

Q: Do I have to elect FSA or HSA and voluntary benefits again?

A: YES.

Q: Can I elect a FSA and HSA benefit?

A: Unfortunately, no. You must choose between the two benefits.

Have more questions? Please feel free to contact me at mhays@vandykmortgage.com, or Brenna Toland at btoland@vandykmortgage.com.

Thank you!

Margarita Hays

This is from the IRS website

The IRS has not yet announced a date that it will begin accepting individual tax returns for the 2018 tax filing season. At the present time, the IRS is continuing to update its programming and processing systems for 2018. In addition, the IRS continues to closely monitor potential legislation that could affect the 2018 tax season, including a number of “extender” tax provisions that expired at the end of 2016 that could potentially be renewed for tax year 2017 by Congress.

The IRS anticipates it will not be at a point to announce a filing season start date until later in the calendar year. The IRS will continue to work closely with the nation’s tax professionals and software community as preparations continue for the 2018 tax filing season.

Speculation on the Internet that the IRS will begin accepting tax returns on Jan. 22 or after the Martin Luther King Jr. Day holiday in January is inaccurate and misleading; no such date has been set.

Refund Timing

In addition, the IRS cautions taxpayers from relying on misleading refund charts on the internet that project tax refund dates. Any speculation about refund dates in 2018 is premature. In addition, these refund charts can overlook that many different factors affect the timing of tax refunds, ranging from the accuracy of information on the return to whether a taxpayer files electronically. In addition, the IRS and state revenue departments have increased their security protocols against identity theft and refund fraud, which also can affect the timing of federal and state refunds.

The IRS issues more than nine out of 10 refunds in less than 21 days. However, it’s possible your tax return may require additional review and take longer. Where’s My Refund? has the most up to date information available about your refund. The tool is updated no more than once a day so you don’t need to check more often. If you use a mobile device you can download the IRS2Go app to check your refund status.

E-File coupled with Direct Deposit remains the fastest way for taxpayers to receive their refunds.

Due to law changes first affecting last year’s returns, the IRS cannot issue refunds for tax returns claiming the EITC or ACTC before mid-February. This law requires the IRS to hold the entire refund — even the portion not associated with the EITC or ACTC. However, there is no need to wait to file such returns since the IRS will process them to the point of refund and then begin refund release when permitted by law.

https://www.irs.gov/newsroom/irs-statement-on-2018-filing-season-start-date