Locking a Brokered Loan – Lender vs Borrower Paid

VanDyk has contractual compensatory agreements with the lenders we broker loans to. When locking your loans, you will need to ensure the minimum compensation is met. This document will help you understand the difference between Lender and Borrower paid compensation, the two options given by the lenders in their various pricing engines.

Borrower- Paid:

The compensation to the broker (VanDyk) is paid at closing on the CD by the borrower. The fee (usually between 2-2.75%) is collected as a broker compensation fee on the Closing Disclosure in addition to the Lender’s fees.

In this example from A&D, the interest rate quoted is 7.49% with the borrower paying the broker’s compensation. The borrower will be charged 2% on the CD for this transaction.

Lender- Paid:

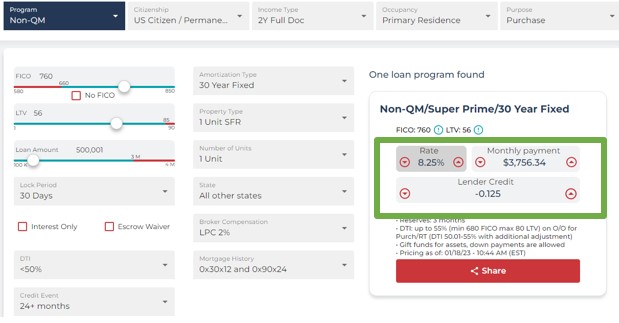

Using the same scenario, we change the compensation to Lender Paid. This means the 2% compensation paid to VanDyk is built into the interest rate and paid by the Lender (A&D) to the broker (VanDyk) and not collected on the CD. The interest rate is 8.25% instead of 7.49%.

It is important to understand that the total compensation being locked in is not the end LO compensation amount, but the amount the lender will deliver to VanDyk Mortgage from which all the expenses will be deducted from (Branch Comp, LO Comp, Processing fee, etc.).

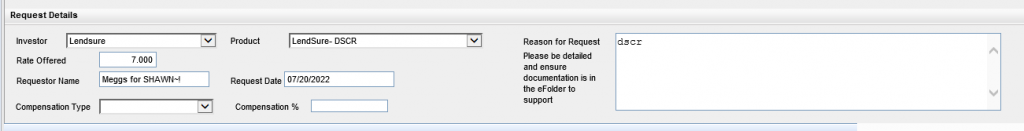

When you submit the Brokered Loan Request in Encompass, you will need to ensure to enter the compensation type and amount (%) are entered:

If you have questions or need help locking in a brokered loan, please contact ProductionSupport@vandykmortgage.com