Secondary Commentary: Rates are Falling

Before you read any further, I want to premise with the fact that this is an opinion, MY OPINION, and the intention of it is to help you form an opinion. I don’t have a crystal ball, no direct line to Mr. Powell or Mr. Trump, no insider info, and no magic tweeting power (looking at you Trump) or even know how to tweet. I can’t tell you what is going to happen in 2020 with rates. I can however tell you what happened so far this year and things to be on the lookout for.

What a Start to 2020

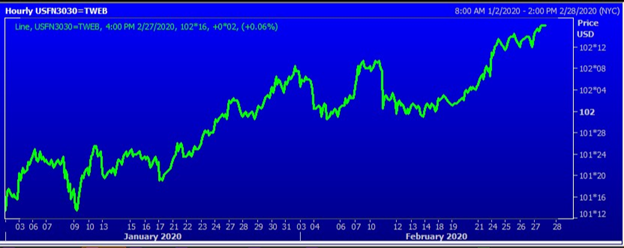

Below is a chart of the UMBS market 3 Coupon from 01/01/2020-02/27/2020. As the chart below shows, we have seen a quick push to higher MBS prices, which translates to lower rates. The year started at 101*13 and as of late 02/27 was at 102*16. So we are looking at a 35/32nds move. That can equate to roughly .25-.375% lower rates. While that is a large movement, that hasn’t been the biggest driver of the recent rate improvement. The 2.5 Coupon is the biggest driver of that (see below).

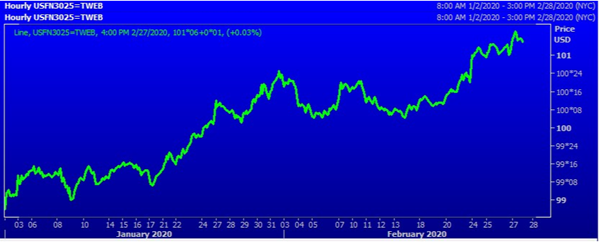

Below is a chart of the UMBS market 2.5 Coupon from 01/01/2020-02/27/2020. As the chart below shows, we have seen a quick push to higher MBS prices, which translates to lower rates. The 2.5coupon started the year at 98*28 and is currently is at 101*06 as of late afternoon on 02/27. That is a 74/32nds rally in a 2 month span. That can equate to roughly .5-.625% drop in rates. The 2.5 coupon is what pricing is based on for the lower end of the rate spectrum (2.75-3.5/3.625).

WTF – Why the Fall…in rates

Some of you may remember this statement from the 2019 Year-End Secondary Commentary:

The general consensus from the Fed seems to be that they will leave the funds rate alone through 2020 unless something major happens domestically or abroad.

Coronavirus is the “something major” that has caused rates to plummet to near all-time lows. There is increasing fear that the coronavirus is going to not only impact China’s economy, but the world economy as well. Each day that goes by, more numbers come out about who has the virus and where they are located. As the virus continues to spread, global economies have jumped ship on “risky” assets (stocks) and pushed money into safe haven assets (like US treasuries). This is why the 10 year US treasury is at its all-time low (as of 02/27).

Coronavirus is the main reason for the fall in interest rates, but there are still other factors at play as well. The Democratic primary continues to rage on, and there is increasing beliefs that the candidate of choice will be more social… “fiscally liberal” than ever before. This could be seen as bad news for stocks after 4 years of a President who worked to increase the stock market with his policies. The other piece of data that is driving the push down in rates just happens to be corporate data. Corporate earnings have been coming out to start the year and so far, those earnings have not been as good as anticipated.

How Far Will We Fall?

If I knew the answer to this, I would not be writing this commentary. Rates are at or near historical lows. The 10-year and 30-year treasuries are also historically low. If coronavirus continues to spread and is officially labeled a pandemic (could argue it already is), then we could see rates fall even further. The market, meaning MBS investors and our aggregators, is still trying to wrap its head around the drastic rate fall. They likely are not pushing through all of the gains they are seeing in the market, as they are fighting off incredibly high pre-pay speeds as lenders storm ahead with refinancing databases. I personally am of the belief that we are at (or near) the bottom of where rates can go.

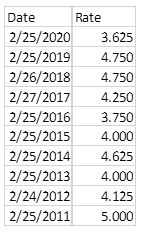

Below is a chart of where rates have been, on or around February 25 for the past 10 years. While I think there is room for rates to go even lower, I wouldn’t bank on it. I firmly believe there is much more downside risk to floating than there is upside potential. Locking in the mid to lower 3s is incredible – many thought we would never see this again after 2016.

Things to Monitor

Continue to monitor the coronavirus and the global impact it is having. We also need to be on the lookout for how the Fed will respond to the virus. With the fear of a global slowdown increasing as the virus spreads, some are thinking that the Fed may be forced to lower their rate target faster than expected. This could potentially turn what seems to be a neutral Fed to a Dovish Fed.

We also need to keep a close eye on the Democratic primary and the general election. Super Tuesday is next week, and we should start to see the field narrow after that. The slimmed-down field should give us the opportunity to learn more about the fiscal policies from the Democratic side. If there is a more liberal view in the policies, this could have an impact on the markets.

Keep Grinding

Typically the industry is “slower” in the 1st quarter, but this year has not been slow. I’m not sure that anyone even had a chance to come up for a breath of fresh air this year. We are seeing record numbers of applications, and our pipelines are swelling. It’s hard to complain when we have been given a great opportunity to help so many borrowers get low interest rates. Keep on grinding and let’s make 2020 the best year yet.

Thanks and Happy Month End,

Brad Chatel

Secondary Manager

Andrew Brown says:

Good Commentary! Let’s keep up the grind team!