Before you read any further, I want to preface with the fact that this is an opinion, MY OPINION, and the intention of it is to help you form an opinion. I don’t have a crystal ball, no direct line to Mr. Powell or Mr. Trump, no insider info, and no magic tweeting power (looking at you Trump) or even know how to tweet. I can’t tell you what is going to happen in 2020 with rates. However, I can tell you what happened in 2019, and what the current expectations are for 2020 in hopes that you can make more informed decisions, and have more educated conversations with your borrowers and realtor relationships.

2019

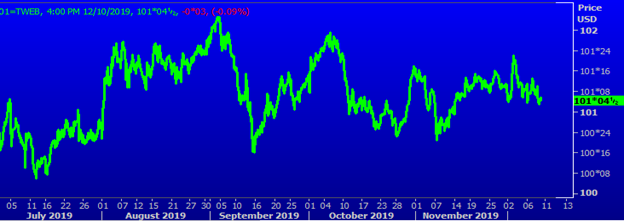

Below is a chart of the UMBS market 3 Coupon from 01/01/2019-12/10/2019. As the chart below shows, we have seen a trend of higher UMBS prices which translates to lower interest rates. We started the year about 4pts lower on the UMBS 3 coupon market than we sit today. 4pts equates to roughly .625-1.00% in lower rates than we were quoting in January. This was a pretty gradual rally that didn’t hit its real strides until the end of Q2.

Since 7/2, we have been hovering in a really nice resistance band on the UMBS market. The low was reached on 9/13 at 100*17 and the high was reached on 9/4 at 102*04. Outside of the high and lows, we have been mostly in the range of 100*24 and 101*16. While that is a 24/32nds difference, it has allowed for some stability in the market. We have seen the ups and downs as usual, but the last 6 months or so have been really resistant to move to much higher rates or much lower rates.

Fed Changes Course

If you review my 2018 EOY commentary, it was widely expected that 2019 would see rates in the 5s with the FED continuing to increase the Fed funds rate. In a reversal of course, the Fed actually began reducing the fed funds rate effective on 7/31 and proceeded to reduce 2 more times throughout 2019.

The Fed cautioned against a slowing global economy along with global trade tensions as a primary reason for their reversal. They proceeded to state that domestic data remained strong and the idea of the economic expansion period in the US ending was not an immediate risk.

As expected, the Federal Reserve left rates unchanged on 12/12/19, stating that depending on major global developments or substantial shifts in inflation, it will remain on hold. The general consensus from the Fed seems to be that they will leave the funds rate alone through 2020 unless something major happens domestically or abroad. In Fed Chair Powell’s statement, he made it sound as if the Fed is going to keep the funds rate low a little longer to keep inflation higher to maintain a strong economy.

Don’t Call it a Comeback – Refinances

Just when everyone thought the refinance boom was over, the market took a 180 turn and decided to toss the industry a bone. Most loans closed in 2018-early 2019 quickly became eligible for a refinance with the rally we saw to start 2019. There were several companies on the verge of acquisition or closure that quickly realized an opportunity and pounced. Several branches here capitalized as well and saw a production increase due to past clients.

While we are a purchase-centric company and never want to take our eyes off our bread and butter, we do realize that our past clients will be solicited whether it is by us or someone else. Should you have excess capacity or want to supplement a pipeline that is struggling with the slower months, this may be an opportunity. If you want us to scrub your pipeline for possible refi leads, please let me know. I will gladly run a pipeline report for you.

2020

Interest rate outlook

I don’t have a crystal ball to predict what rates will do in 2020 – if I did, I probably wouldn’t be writing this commentary. I can say that the FED turned Dovish in 2019 and I do not see that changing back to Hawkish any time in 2020. The FED has made it pretty clear they are taking both the global economy and trade tensions into consideration. Until we start to see stronger data from the Global economy and eased trade tensions, I don’t see the FED moving off their Dovish stance.

I think 2020 will remain a very strong interest rate environment. What does very strong mean? Likely in the 4s for most of 2020. The FED seems to be in a holding pattern in terms of their economic policy, and unless something major happens on the global stage or domestically, they appear to be riding their current policy through November’s election.

Have the locking conversation early and often with your borrowers. While we have been operating with some pretty concrete upper and lower bounds on the UMBS market, we are still seeing the swaying between the bounds. We feel there is much more downside risk in the current rate market than there is upside risk. One day, trade talks may come out positive causing the market to react negatively, and one week later we could have the complete opposite happen. Could a rally into the mid to low 3s happen, sure, but so could a quick turn into the high 4s or even 5s. We don’t have a way to protect against the downside risk, we do however have a way to protect against the upside risk – that being the renegotiation policy after locking. While it is only to be used to save a deal, if push comes to shove it should allow you to keep a borrower happy if rates improve drastically.

Election year

One thing to keep on the back burner is that 2020 is an election year. Election years tend to be relatively quiet in terms of sweeping policy changes. The FED will also likely try to skate through the election year without pushing too many economic buttons unless completely necessary. As election time comes, it will be important to have the lock button near. When President Trump was elected, we saw some very drastic market swings. You can likely expect the same if we see a change to a Democrat elected.

Opportunities

The market handed us a nice rate environment to end 2019. It is on us as a company and industry to capitalize on this while it lasts. No one can predict how long this low rate environment will be around. If we take advantage, we all should have an extremely successful start to 2020.

To 2020

I truly believe this is a year to take advantage of the still historically low rates. We are expecting to see a strong purchase market, and refinance opportunities will be there to supplement as well. We have so many great tools at our disposal here at VanDyk – I believe we are well positioned to seize the opportunity that 2020 is providing us.

I hope everyone has a Happy New Year. Looking forward to a strong and successful 2020.

Brad Chatel

Secondary Manager

Denise Meck says:

Great predictions as I am taking this in the middle of the election on November 5th 2020 and the winner still has not been declared!