Topics in the Announcement

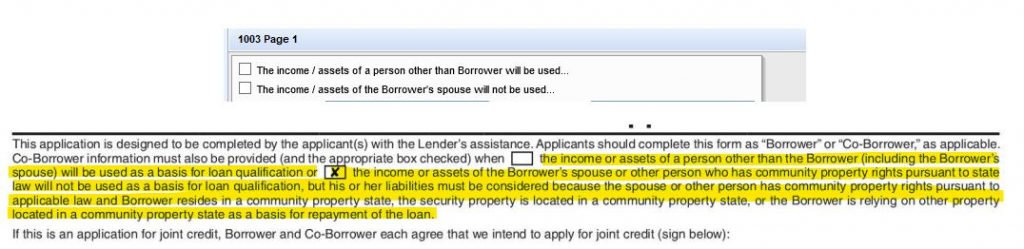

Non-Borrowing Spouses, must sign the initial CD for rescindable refinances:

For Primary Refinances, all non-borrowing spouses and/or any non-borrowing party with ownership interest in the property (with the right to rescind) needs to sign the initials CD 3 days prior to closing as well as any redisclosed CDs prior to closing. This procedure only applies to rescindable refinances.

Please ensure the non-borrowing spouse/parties name, email, and eConsent (if eSigning) is provided as early as possible to prevent any delays in disclosure.

Smart Fees & Transfer Taxes

To streamline the initial disclosure procedure across all states, the compliance team will begin relying on and disclosing the transfer figures that are pulled in by Smart Fees. Compliance will continue to double check the figures are accurate, but will no longer convert the transfer tax figures to Encompass equations.

Most states will not notice any change in procedure, but those operating in Florida will see a difference in how the transfer taxes are mapped on lines 1203, 1204, and 1205.

Encompass:

- 1203 = Empty

- 1204 = Doc/Mortgage Stamps & Intangible Tax

- 1205 = Transfer Deed Tax

Smart Fees:

- 1203 = Intangible

- 1204 = Empty

- 1205 = Doc/Mortgage Stamps & Transfer Deed Tax

- Who pays (buyer or seller) for the Transfer Deed Tax can be determined when running Smart Fees.

Dynamic Data Management (DDM)

DDM is an Encompass feature that allows us to pre-set loan data based on loan criteria. It can also be used to update mortgage insurance data as loan factors change.

Branch Fees: We will be using DDM to pre-set the 800 level branch fees based on the User Organization Code (OrgID) assigned to each branch.

DDM rules function differently than the Business Rules we are used to in Encompass. They do not instantly change data, but rather will only fire upon save, and rewrite data during the saving process. When activated for the 800 level fees, those fees will be editable for the branches, but if altered from the original specified amount, the rule will overwrite any changes and return the fee to the original amount upon saving. DDM rules can be overridden on a loan level, but will require management approval to do so.

The following fees will be governed by this rule once active:

- Origination Fee

- Processing Fee

- Underwriting Fee

We will begin to roll this out in the coming weeks.

Mortgage Insurance:

On Conventional loans, DDM will still allow the PMI premium to be edited by the branch, but will auto-populate the supporting data such as number of months needed, and the cancellation at 78%. Government loans are being tested, and more information will be provided once available.

Manufactured Home Tags

New manufactured homes contain both interior and exterior labels. Over time, either or both may be removed by the owners. When missing, we must verify the information from a company called IBTS. https://lvr2.ibts.org/#/LandingPage Their website calls the document for the exterior plate a “Label Verification Letter” and the interior plate the “Data Plate/Performance Certificate. If both are missing there will be two underwriting conditions. The conditions in Encompass have been reworded to match what the documents are called on the IBTS website. We hope this change will make it clear the document(s) required for the loan.

Floify E-sign

Floify provides an in-house e-signature solution supporting customized fields from both the borrower and lender side and beginning February 1, 2021, the Floify E-Sign solution will replace DocuSign as the available function for “one off” documents (letters of explanation, appraisal delivery, etc.) requiring any e-signature.

**NOTE** Initial Disclosures and Re-Disclosures will be issued by the VDM Compliance Team through the DocuSign extension we have connected with Floify.

Loan teams can create an e-signature request directly in the borrower’s loan flow very similar to how you do now. The loan’s borrower(s) will be notified that there is a new e-signature request awaiting their attention, and the borrower(s) will be prompted to login to their Floify account, which will then identify their signature role.

Once an e-signature request has been completed by all recipients, the document will be delivered to the yellow pending bucket in the Floify loan flow to await final review and approval. Once accepted you will need to take the additional step of pushing the e-signed document into Encompass, it will not automatically push.

Attached is a tutorial on how to install Floify E-sign and create one-off Floify E-sign requests: Floify eSign Updated Training 1.19.21 Following is the link to the Floify Help Center which also provides a tutorial – but you do have to login to access it. Please reach out to Production Support for assistance or with any questions. https://help.floify.com/hc/en-us/articles/360048246912-Floify-E-Sign-Tutorial

FHA Case Number and Appraisal Transfers

There is significant information needed both by us and the other lender to successfully complete a transfer of an FHA Case number and appraisal. Attached is a new form that can be used to obtain a transfer from another lender to VanDyk. Also attached are updated instructions for transfers both from and to VanDyk Mortgage. FHA Appraisal Transfer Instructions updated 1-21-21 – FHA Case Number Transfer from another lender

Freddie Mac Matrix LTV’s updated to mirror Freddie Mac maximums

Revised matrix is attached: Freddie Mac Fixed Rate and ARM Conventional Matrix January 21, 2021

2020 W2’s

Loans closing on or after 2/1/2021 require the 2020 W2 or the year-end paystub. Applications taken after 1/31, the 2020 W2 will be required prior to closing.

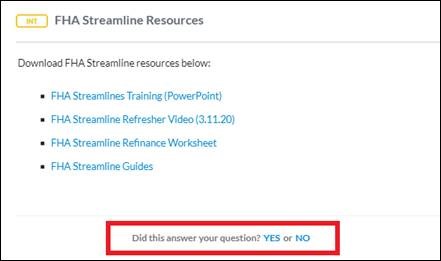

FHA Streamline Refinance Max Mortgage Worksheet

Attached please find an updated FHA Streamline worksheet with an additional line added to allow inclusion of escrow shortage and late fees: FHA Streamline refinance Worksheet 1.21.21

Income Calculation Worksheet

Attached please find our Income worksheet that has been updated to reflect 2021: 2021 Income Calculation Worksheet

Cutoffs

The updated Underwriting and Closing cutoff times are as follows:

Purchases:

- Underwriting = Resubmitted by 4pm 4 business days prior to ECD.

- Closing = Clear to Close by 8am 24 hours prior to your ECD.

- Reminder, please be sure to have the following if close to cutoff:

- Finals in the file (VOEs, HOI Re-verifications, etc).

- No outstanding conditions

- Schedule closing for afternoon on ECD if possible.

- Reminder, please be sure to have the following if close to cutoff:

Refinance/Bond/Renovations:

- Underwriting = Resubmitted by 4pm 5 business days prior to your ECD.

- Closing = Clear to Close by 8am 48 hours prior to your ECD.

Moving an ECD – Request must meet cutoff:

If your loan file does not meet the above cutoffs your ECD will be adjusted by the pipeline manager (Amber Workman) or the closing department. Once your file is CTC you can request your ECD to be moved up, however the new ECD must meet the above closing cutoff at the time the request is made. Closing needs a minimum of 24hrs to accurately work a file once CTC. So even if your file is CTC, if your ECD is inaccurate and needs to be moved up, the request to do so must be submitted by 8am 24hrs (Purchase) to 48 hours (Refi/Bond/Reno) prior to your ECD to be accommodated.

Wet Signed Docs – Timing Requirements

As a reminder, we require all time sensitive documents (LEs, CDs, TX 12 Day notice, etc.) wet signed by the borrowers to be uploaded into the eFolder before the document timing restrictions take effect. Given the lack of tracking/validation with wet sign documents Closing/Compliance will rely upon the eFolder upload date for timing purposes.

Tax Return and Transcripts Cheat Sheet updated for 2021

Attached please find our updated Cheat Sheet with guidance on tax returns and transcripts required based on application and note dates: 2021 Tax Return and Transcripts Cheat Sheet January 2021

FHA to Permit DACA Status

Effective January 19, 2021 FHA is permitting individuals classified under the “Deferred Action for Childhood Arrivals” program (DACA) with the USCIS and are legally permitted to work in the U.S. are eligible to apply for mortgages backed by the FHA. See attached FHA Info #21-04: DACA SFH_FHA_INFO_21-04

USDA Asset Accounts

Two months statements for all/any asset accounts are required for the borrower, as well as an non-borrowing household member for review of possible income.

♦

Hazard Insurance – Proof of Payment

Reminder – Proof of payment is required on all current HOI policies if the premium is not being collected on the CD. If no proof of payment is available, the full premium will be collected on the CD at closing.

Also, if the current HOI policy is expiring before the first payment due, the new premium amount will need to be collected on the CD.

♦

Fannie Mae HomeStyle Renovation Loan LTV’s reflected by Encompass

The LTV shown at the top of the page in Encompass and also on the Transmittal Summary are not calculated correctly by Encompass. You must rely upon the LTV reflected by the AUS in determining the required PMI Coverage etc.

♦

Bond Loans

Flood policies must be NFIP for bond loans. Private flood policies are not acceptable.

♦

MSHDA

MSHA requires a Declaration Page for hazard policies (and also evidence of payment as published in the December announcement).

Please also note, they are currently 45 days out on reviews.

January 2021 Lending Announcement

Click Start Challenge to begin!