Topics in the Announcement

August 19, 2021

- Jumbo Loans

We have been working to secure Investor outlets for Jumbo loans over the past several months. In April we launched Truist, and since then we have received approvals to sell loans to Chase and Pentagon Federal Credit Union (PenFed). Both Chase and PenFed are priced much more competitively than Truist and will allow us to gain more of the non-conforming market. Beginning today (8/19), you will be able to price loans within CPPE to these Investors. Prior to locking we will require UW approval. As a best practice, once you have a loan identified for either Chase or PenFed please send that loan to JumboLoanReview@vandykmortgage.com, and the UW Team assigned to these loans will review and let you know the minimum documentation that will be needed to review for lock approval. We can underwrite these loans as TBD files and encourage you to submit them prior to origination when possible. We have applications with other Investors pending approval and you will see additional outlets for the Jumbo loans in the coming months.

A few important notes –

- ONLY FIXED RATE PRODUCTS are eligible

CHASE:

- The Chase jumbo product is a manual review and application of Chase’s credit guidelines. Chase only approves a very particular credit profile and this is where we have seen seemingly excellent applications not qualify.

- Due to Chase’s requirements, we will be looking for the following minimum documentation to approve a lock:

- Credit report for all borrowers

- Income documentation, including Loan Beam for SE borrowers

- Assets or as accurately added to Encompass

- Eligibility matrix for the Chase Non-Agency Jumbo product is attached. Please note there are several state-specific restrictions you will want to make sure you apply. We will publish full investor guidelines for Chase as soon as we have companywide access with AllRegs.

PenFed:

- PenFed uses DU as for credit review. You should run DU on all your jumbo files so you will know if PenFed is also an option. You will be looking for Approve/Ineligible findings, and you should specifically review to make sure the Ineligible is due to loan amount and nothing else.

- PenFed is currently a non-delegated underwrite which requires a pre-funding review and turn times are currently 4- 5 days. We expect to be full delegated with PenFed by end of September. Certain documentation is required in the file before we can send to PenFed, they are:

- DU findings

- Credit report for all borrowers

- Income documentation, including Loan Beam for SE borrowers

- Assets or as accurately added to Encompass

- Eligibility matrix for the PenFed Correspondent product is attached. Full guidelines may be accessed by creating an account here: PenFed Correspondent Guidelines

- Brokered Loan Process

As a reminder: beginning September 1, newly originated brokered loans will all be processed by our in-house brokered loan specialist. Megan Crowley and Maryann Stanco have been working diligently on a file flow that will maintain transparency while delivering great service and insuring VDM compliance standards. A detailed overview of the process is attached. We will have a training call on Friday, 8/27 to go over the full process. We will also provide an overview of our current broker partners and who does what. Watch your inbox for the invitation!

- Credit Report Pull Requirements

There are some important changes being made in Encompass that will allow us as a company to forecast better, improve conversion, and evaluate ROI so that we can make ensure we have the best resources available to you.

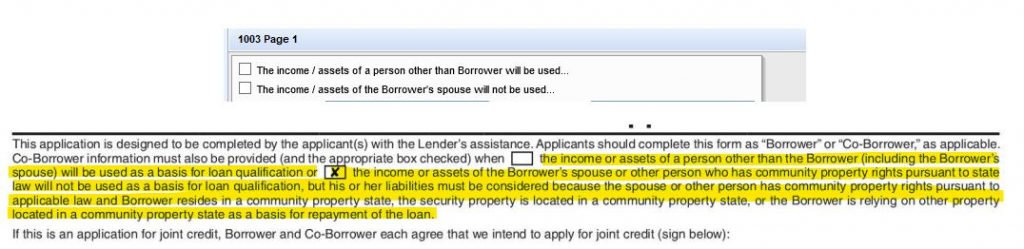

Going forward there will be three mandatory fields in Encompass that will be required to complete before the system will allow you to pull credit.

- Lead Status

- The lead status field is used to execute our hot, cold and refinance campaigns. LOs and Branches utilizing these campaigns have seen a marked improvement in conversion over the years.

- The hot campaign is designed to help you stay in front of the borrower while they are in the home shopping process.

- The Cold campaign is used in the event that our answer is a “not now” and as a Mortgage professional have counseled them on the necessary steps to be able to get approved for financing down the road.

- The great thing about both of these campaigns is that while they are automated, there are alerts you can set up in TOM to remind you to make contact beyond the passive emails. They even include suggested scripts. You can also access the parts of the hot/cold campaigns that have alerts in the dashboard of your TOM account.

- Lead Category

- By filling out the lead Category field we will be able to better track ROI on your marketing efforts. Leads you buy, leads from company website, sales boomerang, your networking groups and so much more. You will be able to get a quick look at where your business is primarily coming from at a quick glance. Your RMs will be able to work with you during your monthly 1-2-1s to help you analyze this data and make sure we are keying in on the top sources of your business.

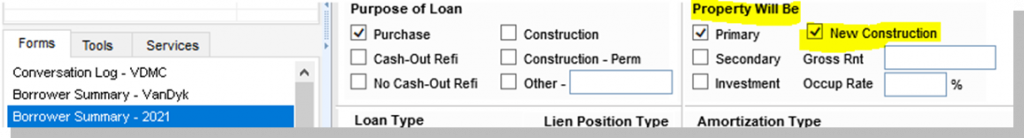

- Purpose of Loan

- These fields identify whether a borrower is a purchase, refinance etc.

- By filling out these fields we are better able to forecast our business and make sure that we have the resources available to process, underwrite and close your loans.

- We have learned over the past 18 months that each loan type has a different conversion percentage as well as a different length of time to close.

- We will use this data to be able to forecast more precisely.

As we have shared with you before our vision is to create a mortgage company that everyone wants to work at. That vision has no finish line so we are always looking for ways to improve processes, resources, and systems that will continue to help you grow your business.

- Freddie Mac Refi Possible: Coming Soon

Freddie Mac’s no-cash out offering for low-income Borrowers will be available on submissions to LPA on or after 8/30/21. Please see attached matrix and bulletin for more information.

Technology Update: Encompass Enhancements!

Updates to Previous Enhancements:

Notes

- We have added the ability to assign a person to the file that does not fit into a specific milestone role. Go to File Contacts and assign them under General Assistant. Then that user will be available to choose to email in Notes.

- Your email signature now is added to the outbound emails so you can email borrowers from Notes as well. Be sure your preferred signature is listed first in your Outlook settings, as this is the signature Notes pulls to email from. If necessary, you may need to rename your preferred signature with an “A” or “1” to get it to be listed first.

- When emailing internal departments like closing and underwriting please add the loan number to the subject line for easy identification.

USPS Address Validation

- No longer brings over the extra 4 digits in the ZIP code – this resolve issues with the pricing engine.

New Features

- Loan Information bars: We have installed a new panel which allows quick access to information, the loan timeline, and forms bar based on persona. You can open and close these bars by the carat in the top left corner of Encompass.

- Menu tab for VanDyk: In the top left of Encompass is a green VanDyk tab for quick access to other resources we use daily.

- Sandbox:

Entering a loan in the Sandbox mode deactivates the ‘Save’ functionality and allows users to perform actions in Encompass that do not require saving. Users are able to make changes to the loan and work scenarios without having to worry about permanently changing the current structure of the loan.

Finding the Sandbox tool

First, locate your loan in the Pipeline view. Then, you can enter Sandbox Mode in one of the following ways:

- Right-click the file and choose Enter Loan in Sandbox Mode OR

- With the Loan selected in the pipeline, click the Pipeline menu at the top and choose Enter Loan in Sandbox Mode.

A confirmation message will be displayed once the loan has been entered while using the Sandbox Mode. The Save Icon is Disabled while in Sandbox Mode.

Note: Opening the loan in the Sandbox Mode will remove the User’s ability order Services from within Encompass. In addition, Users will not be able to add/remove documents from the eFolder.

How are your emails being received?

Our industry has been incredibly busy over the last year (and then some), and we’re all feeling the pressure. Don’t forget: we are all on the same team!

Take a moment to review your emails before sending them. Think about the tone in which you’re writing – will it be received the way you intend?

For more helpful hints, take a moment to review this article from Psychology Today: Don’t Type at Me Like That! Email and Emotions. See also the attachment: Email Etiquette and Tips.

Voluntary Flood Insurance: Cannot Be Escrowed

A property must be in a flood zone for flood insurance to be included in escrows.

We cannot escrow for flood insurance that was purchased voluntarily by the borrower – it must be paid by the borrower directly.

Hazard Insurance Effective Dates: Must be within Same Month as Closing

HOI effective dates need to be within 10 days of the closing date, except if the Closing Date pushes into the next month.

The HOI policy will have to be updated so the effective date falls within the same month of closing, regardless of the number of days between from the closing date.

August 2021 Lending Announcement

Click Start Challenge to begin!