February 17, 2022

- Adverse Status Verification Notice

A new notice will be uploaded to the eFolder for loans that are Closed for Incompleteness or Approved not Accepted. Please see the attached example. This is an internal form that will not be mailed to the borrower.

- New Workflow for Condominium Reviews – Beginning February 28

For all files with “Condo Order/Screening” dates entered on or after Feb 28th, there will be a new workflow affecting the ordering, follow up for, and underwriting of Condo Review documentation. The new workflow is currently being tested, and will involve the following basic structure. Training will be provided at the Processing Round Table next week Tuesday – please email Production Support if you need the invitation.

Basic Workflow Changes:

- Branch/Processing, will request “Condo Screening” (Borr Summary Screen, as usual).

- Condo Dept, will screen the file, add UW Condo Conditions, and email the branches with instructions for their order.

- Branch/Loan Processing, will order, pay for, and receive all condo docs themselves, and upload them to the eFolder. (Condo Dept available to screenshare and answer questions)

- Loan Processors, will request “Condo Resub” (Borr Summary Screen) when they a have sufficient amount of documentation for Condo Dept to review. They will also “Fulfill” any Condo Conditions.

- Condo Dept, will review fulfilled conditions within 24-48 hours, update conditions accordingly, and return the file to loan processors for any missing/added documentation requests, and any requests for clarification.

**Condo Dept, will also email the conditions to the loan processor when the file is “returned” to them after a resub.

- California DPA Program: Golden State Finance Authority

Starting Tuesday March 1st Golden State Finance Authority (GSFA) loans can be originated using the Platinum Program only. Please see the GSFA Launch attachment for more details. Also attached is the required bond lock form.

- Fannie & Freddie – Updated SE Requirements

EFFECTIVE IMMEDIATELY – Fannie Mae and Freddie Mac have discontinued the temporary Covid-19 requirements for P&Ls and supporting bank statements so long as the 2020 and/or 2021 tax return are used in qualification. This guidance may be applied to all loans in the pipeline as applicable, including all government loan products, except when required per standard agency requirements (see seller guides or handbooks for applicable guidance).

- Jumbo Updates

We are opening up Jumbo Loans for loan amounts over $3MM with the following requirements:

- Lending Committee review of salient information (employment/income, DTI, credit history, property)

- LTV Restrictions:

- $3,000,000 – $3,500,000: 80% LTV

- $3,500,001 – $4,000,000: 70% LTV

- $4,000,001 – $5,000,000: 60% LTV

- $5,000,001+: 50% LTV

- ARM Options

ARM loans are now available for pricing on CONVENTIONAL loan products. There are a few restrictions as these must be sold directly to Chase. Full ARM guidance attached and also available in AllRegs.

- Restrictions of note:

- Min FICO: 660; all applicants must have a valid credit score

- Property: No Manufactured (including ADU)

- Home Ready/Home Possible

- Appraisal Waivers on Condo or PUDs.

- Max # of borrowers: 4

- Desktop Appraisals

Fannie Mae and Freddie Mac will begin issuing new appraisal messaging indicating when a loan is eligible for a Desktop Appraisal. Borrowers may still elect to have a full appraisal. Several types of collateral will be ineligible, including condos, coops, manufactured housing, second homes and properties which have resale restrictions.

Freddie’s messaging will begin for loans submitted starting March 6 and Fannie beginning March 19. Fact sheets and announcements are attached.

- 2021 Tax Form Requirements

For loan applications dated on or after 1/31/22, W2s for the 2021 tax year are required, and transcripts as applicable. For 2021 Tax Return requirements, please refer to 2021 Tax Transcript Cheat Sheet, attached.

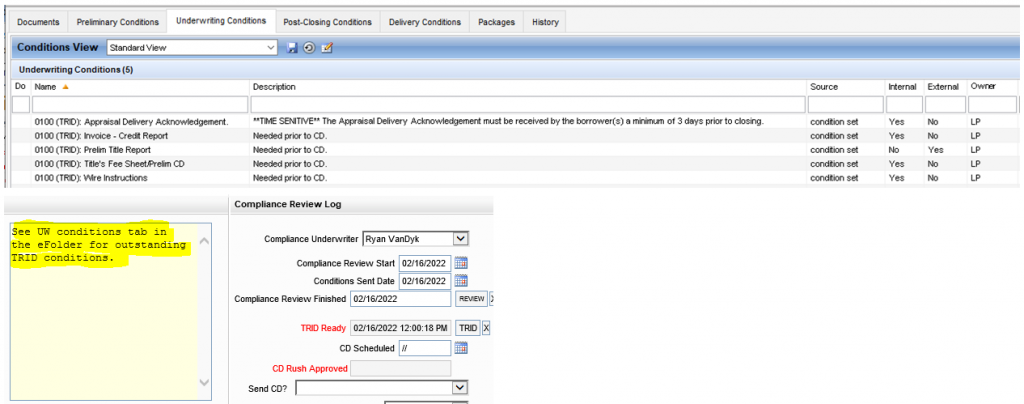

- Updates to TRID Conditions

We have changed the TRID Review workflow. Compliance will now be completing the TRID review as soon as the file has been Conditionally Approved and locked. If there are any outstanding condtions they will be added to the UW Conditions Tab in the eFolder.

Branch will no longer need to mark their files “TRID Ready” for an additional review from Compliance. Instead, please ensure all TRID condtions are cleared to indicate the file has all required documentation to pass TRID.

- Encompass E-Folder Enhancements – Junk Folders, File Manager and “Protected Documents”

In our effort to continue to improve our Encompass work environment, we have implemented some new E-Folder enhancements.

In production right now, the File Manager/Unassigned is now open to all users to add, edit and file documents, including the Underwriter personas.

We have a true “junk” folder now for documents that will not be used for underwriting. The “Left Side Junk” document placeholder is now only visible to LOs, LOAs, TCs/CSAs, LPs and PAs.

Finally, E-Folder documents will become “protected” and unable to be edited by staff once an Underwriter marks a document “Ready to Ship”. Those documents in “Ready to Ship” status will become view only to every other persona, and new document placeholders will need to be added if you need to provide additional documentation within the same category.

We expect that these enhancements will help improve overall organization of the e-folder documentation and alleviate some pain points uncovered during the workflow review we did in August 2021 with our third party vendor contracted to assist with system improvements.

***

Well & Septic Distance Requirements

FHA revised its property guidelines in 2015 and these revisions supersede guidance issued in previous mortgagee letters with respect to Well & Septic distance requirements.

This DYK is in particular regarding properties in Michigan where FHA had a mortgagee letter from 2000 allowing for reduced distances.

Well & Septic distance waivers may be submitted to the appropriate HOC with the following set of documents, and must be submitted by the DE Underwriter:

1. Water test results including bacteriological and lead

2. Signed letter from borrower, stating the borrower is aware a waiver is required to obtain FHA mortgage insurance

3. Sketch, showing location of well to septic tank, well to drainfield and well to property line.

4. Copy of appraisal showing property does not have access to public water/sewer hookup

* * *

Corporate Tax Returns & Fiscal Year End

Businesses can file income tax returns based on the fiscal year vs the calendar year. The top of the business return must reflect dates if they do not file their return based on a calendar year. Fiscal year forms will reflect the year that the fiscal year began. Fiscal Year Profit and Loss statements will be based on the tax return fiscal year. i.e.: tax return for 10/01/2020 – 09/30/2021 will be filed on a 2020 form. Profit and Loss would then be 10/01/2021-01/31/2022.

If we are later in the year and an extension was filed and the return is not due yet, we would need a full one year P & L and the subsequent months P & L as applicable.

* * *

Encompass Keyboard Shortcuts

As demonstrated at the Fly-in, there are many keyboard shortcuts that can be used to navigate Encompass.

The cheat sheet is attached, but you can also find it by asking Howee “Where can I find Encompass shortcuts?”

February 2022 Lending Announcement

Click "Start Challenge" to begin!

David Vega says:

thanks the information shared is always appreciated.

David Vega says:

I love the information that we get from these.

David Vega says:

great content

David Vega says:

good information

David Vega says:

.