Topics in the Announcement

May 20, 2021

- Non-Owner-Occupied and Second Home Conventional Fixed Rate Refinances Are Back!

Effective immediately, you may price and lock investment and second home refinance transactions, both rate/term and cash-out. Attached please find our revised FannieMae and FreddieMac Matrices.

- TBD Underwrites Are Coming Back!

Starting on June 1st, you may begin submitting TBD files for FHA, VA and USDA loans that require a manual underwrite, and for all loans using income from self-employed borrowers.

- Appraisal Fees Increasing June 1, 2021

Recent comments and requests for fee increases by our appraisal panel led us to review the fees we offer Appraisers when sending out appraisal assignments. We compared our fees to VA (our initial pricing model), AMCs, and recent requests for increases and we found we were low and that we need to increase our fees to remain competitive. Attached you will find the new fee chart for all orders placed after May 28, 2021 and assigned out June 1, 2021.

On the topic of appraisals, we wanted to pass along a helpful article that explains longer appraisal turn times and market conditions: Appraisal Turn Times: Can We Speed Them Up?

- Fannie Mae – VOE/POA COVID Flexibilities Expired

Lender Letter LL-2021-03 attached states that flexibilities related to verbal VOEs and POA are no longer applicable for loan applications dated on or after May 1, 2021. Standard Selling Guide guidelines now apply to these topics. You can find those guidelines here: VOE – POA

- USDA: Updated Income Limits for 2021

The Fiscal Year 2021 income limits for Single-Family Housing Guaranteed Loan Program were published on May 12, 2021. GUS and the Income Eligibility calculator on the Eligibility Website have been updated with the new income limits.

- Freddie Mac Change to Tax Proration Credits

Effective for settlement dates on or after August 5, 2021: We will no longer be able to use tax proration credits on the 1003 for qualification purposes, therefore they cannot be reflected in the credits on the Details of Transaction. We will still be able to add these credits to the CD. Full details are attached.

- New Construction Indicators and Procedure Updates

Last month, we introduced a new loan folder called New Construction to help identify loans that will not be closing immediately. As a reminder, loans should remain in this folder until they are within 60 days of closing.

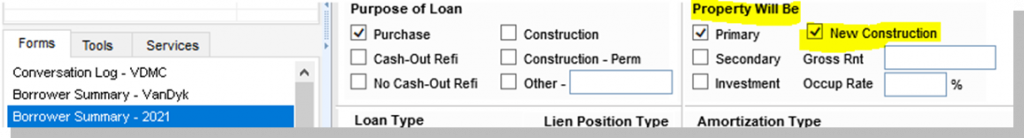

We have also added an indicator field to the Borrower Summary for you all to use (pictured below). This will help the Lending Teams identify which files in the pipeline are New Construction, and will also facilitate moving through the pipeline as purchase loans (on the occasions when the loan purpose is Refinance instead of Purchase).

We are also updating our requirements for Certificates of Occupancy and Final Inspections to be Prior to Funding items when the subject property is in a full new construction community (for example, homes built by Lennar, DR Horton, MI, etc.). It will be the branch’s responsibility to make sure that these items are received in time for funding and to notify the UW when they are uploaded for review.

May 2021 Lending Announcement

Click Start Challenge to begin!

Megan Crowley says:

thanks

Mandy Henwood says:

Thank you.