Wait a moment for the newsletter to load – or scroll down to download a copy!

Wait a moment for the newsletter to load – or scroll down to download a copy!

March 17, 2022

To continue to be competitive in the Jumbo market we are expanding our Investor offerings to include US Bank and Redwood Trust, as well as an ARM product with PenFed. With the addition of US Bank and Redwood we now have 6 options available to help you keep an edge with qualification and rate offerings. Our internal Jumbo Investor at-a-glance comparison is updated for US Bank and RWT. This job aid is attached and also available on Howee.

We are pleased to offer a Retail solution for the Bank Statement and Non-Warrantable Condo opportunity with NewRez! Introducing the SmartSelf (Self-Employment Bank Statement Program) and SmartEdge (Non-Warrantable Condos). These loans will be a hybrid process for underwriting and closing where NewRez will do the underwrite and VDM will handle the closing. Offering a Retail option for the Smart Self and Smart Edge products will allow us to better serve our customers and offer a smoother, less confusing process to them, and will also give us the ability to change loan programs more easily in the event we cannot close a loan through Fannie or Freddie (ie, if a condo is non-warrantable).

Please review the following attachments for process flow, program requirements, and guidelines. Any questions can be directed to nonQM@vandykmortgage.com.

We are excited to announce three new broker partners available to send loans to: Go Mortgage, GoPointDirect, and AD Mortgage!

Beginning Monday, March 21, we will be able to originate loans with Welcome Home Wyoming and DC Housing Finance Authority. Details on these programs and lock forms are attached.

We have decided to expand our current database by approving non-FHA approved and Licensed (non-Certified) Appraisers. Hopefully, this will give us more options to choose from when placing orders. Biggest thing you should think about is if you have a file that is close to qualifying and could convert to FHA/USDA, to make a note when you order requesting an FHA approved Appraiser.

As a reminder, Loan Originator website Apply Now links will be switched to the MyVanDyk/SimpleNexus application on April 1. An additional LO training will be available Monday, March 28 at 2pm Eastern. If you need the invitation re-sent, please email SNTeam@vandykmortgage.com

Previous training recordings are available by asking Howee “Where are the MyVanDyk Training Recordings?” Additional resources and how-to guides are available here and at AskNexus.com.

The below forms are now available for use, and will be the only way to request disclosures for a Loan Estimate or Closing Disclosure come 03/21/2022, as Loan Estimate Page 4 will no longer be accessible.

Instructions and flow charts for the above forms are attached for easy reference.

TBD Locks & Extended Locks

Did you know that VanDyk offers a 90 day lock and shop option for borrowers who are actively looking for homes?

Borrowers get a 90 day lock on a TBD address to find a house and fund the loan. Ask Howee for the TBD lock policy for the full details.

VanDyk also offers lock periods up to 180 days! Just ask Howee about the extended lock policy.

* * *

ValueLink Invoices – Reminder

ValueLink invoices do not itemize appraisal costs. If we have a loan with a rush fee or additional cost, it will be totaled in the Appraisal Fee field on the 2015 Itemization.

Additional fees will no longer be broken out onto their own line items.

* * *

How do I know who is ordering/processing my condo review?

Condo Screening Dates, Before 2/28:

Condo Screening Dates, On or After 2/28:

Questions? Chat Frank Concepcion on Teams!

(wait a moment for the newsletter to display – or scroll down to download!)

(wait a moment for the newsletter to display – or scroll down to download!)

Click Start Challenge to begin!

February 17, 2022

A new notice will be uploaded to the eFolder for loans that are Closed for Incompleteness or Approved not Accepted. Please see the attached example. This is an internal form that will not be mailed to the borrower.

For all files with “Condo Order/Screening” dates entered on or after Feb 28th, there will be a new workflow affecting the ordering, follow up for, and underwriting of Condo Review documentation. The new workflow is currently being tested, and will involve the following basic structure. Training will be provided at the Processing Round Table next week Tuesday – please email Production Support if you need the invitation.

Basic Workflow Changes:

Starting Tuesday March 1st Golden State Finance Authority (GSFA) loans can be originated using the Platinum Program only. Please see the GSFA Launch attachment for more details. Also attached is the required bond lock form.

EFFECTIVE IMMEDIATELY – Fannie Mae and Freddie Mac have discontinued the temporary Covid-19 requirements for P&Ls and supporting bank statements so long as the 2020 and/or 2021 tax return are used in qualification. This guidance may be applied to all loans in the pipeline as applicable, including all government loan products, except when required per standard agency requirements (see seller guides or handbooks for applicable guidance).

We are opening up Jumbo Loans for loan amounts over $3MM with the following requirements:

ARM loans are now available for pricing on CONVENTIONAL loan products. There are a few restrictions as these must be sold directly to Chase. Full ARM guidance attached and also available in AllRegs.

Fannie Mae and Freddie Mac will begin issuing new appraisal messaging indicating when a loan is eligible for a Desktop Appraisal. Borrowers may still elect to have a full appraisal. Several types of collateral will be ineligible, including condos, coops, manufactured housing, second homes and properties which have resale restrictions.

Freddie’s messaging will begin for loans submitted starting March 6 and Fannie beginning March 19. Fact sheets and announcements are attached.

For loan applications dated on or after 1/31/22, W2s for the 2021 tax year are required, and transcripts as applicable. For 2021 Tax Return requirements, please refer to 2021 Tax Transcript Cheat Sheet, attached.

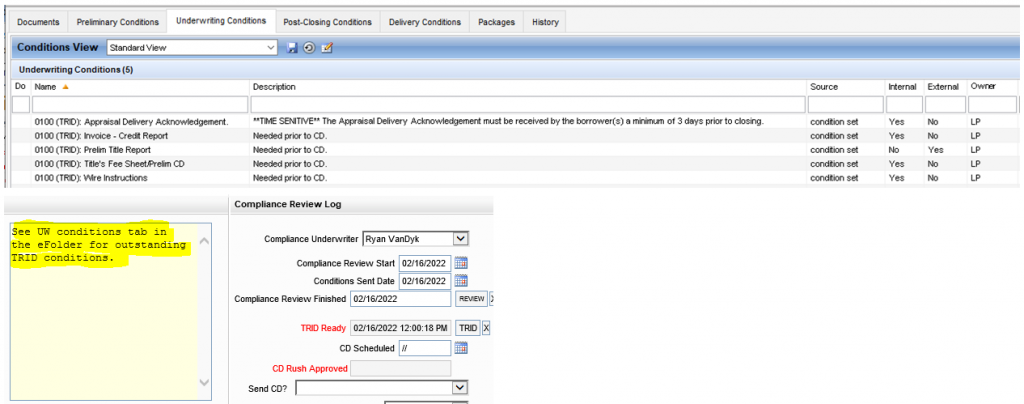

We have changed the TRID Review workflow. Compliance will now be completing the TRID review as soon as the file has been Conditionally Approved and locked. If there are any outstanding condtions they will be added to the UW Conditions Tab in the eFolder.

Branch will no longer need to mark their files “TRID Ready” for an additional review from Compliance. Instead, please ensure all TRID condtions are cleared to indicate the file has all required documentation to pass TRID.

In our effort to continue to improve our Encompass work environment, we have implemented some new E-Folder enhancements.

In production right now, the File Manager/Unassigned is now open to all users to add, edit and file documents, including the Underwriter personas.

We have a true “junk” folder now for documents that will not be used for underwriting. The “Left Side Junk” document placeholder is now only visible to LOs, LOAs, TCs/CSAs, LPs and PAs.

Finally, E-Folder documents will become “protected” and unable to be edited by staff once an Underwriter marks a document “Ready to Ship”. Those documents in “Ready to Ship” status will become view only to every other persona, and new document placeholders will need to be added if you need to provide additional documentation within the same category.

We expect that these enhancements will help improve overall organization of the e-folder documentation and alleviate some pain points uncovered during the workflow review we did in August 2021 with our third party vendor contracted to assist with system improvements.

***

Well & Septic Distance Requirements

FHA revised its property guidelines in 2015 and these revisions supersede guidance issued in previous mortgagee letters with respect to Well & Septic distance requirements.

This DYK is in particular regarding properties in Michigan where FHA had a mortgagee letter from 2000 allowing for reduced distances.

Well & Septic distance waivers may be submitted to the appropriate HOC with the following set of documents, and must be submitted by the DE Underwriter:

1. Water test results including bacteriological and lead

2. Signed letter from borrower, stating the borrower is aware a waiver is required to obtain FHA mortgage insurance

3. Sketch, showing location of well to septic tank, well to drainfield and well to property line.

4. Copy of appraisal showing property does not have access to public water/sewer hookup

* * *

Corporate Tax Returns & Fiscal Year End

Businesses can file income tax returns based on the fiscal year vs the calendar year. The top of the business return must reflect dates if they do not file their return based on a calendar year. Fiscal year forms will reflect the year that the fiscal year began. Fiscal Year Profit and Loss statements will be based on the tax return fiscal year. i.e.: tax return for 10/01/2020 – 09/30/2021 will be filed on a 2020 form. Profit and Loss would then be 10/01/2021-01/31/2022.

If we are later in the year and an extension was filed and the return is not due yet, we would need a full one year P & L and the subsequent months P & L as applicable.

* * *

Encompass Keyboard Shortcuts

As demonstrated at the Fly-in, there are many keyboard shortcuts that can be used to navigate Encompass.

The cheat sheet is attached, but you can also find it by asking Howee “Where can I find Encompass shortcuts?”

Click "Start Challenge" to begin!

(wait a moment for the newsletter to display – or scroll down to download!)

Click Start Challenge to begin!

January 20, 2022

2021 was a follow-up banner year for VanDyk Mortgage. One of our goals in Operations going into 2021 was to put the infrastructure in place in order to scale up the systems which set VDM apart and make this a first class lending shop. Maintaining organization and hierarchy is integral to this goal, and with this in mind we made three underwriting teams – each devoted to a specific regional team of branches. Along with Loree Haugom, we hired Todd Steadman and Mary Dovgin to work with the Midwest, West Coast and Southeast teams. The 3 Regional Underwriting Managers have done an excellent job working with their teams to maintain SLAs, research and resolve escalations expeditiously, and continue to train and promote the VDM culture. As we begin 2022, we are advancing plans to continue improvements with the organization of our underwriting team, and are elevating Todd Steadman to National Underwriting Manager. This will free up Rich to focus on all of Lending and the other Operations and Production teams while giving our Retail Underwriting team and branches a point of contact dedicated to the day to day of Underwriting.

In his capacity as National Underwriting Manager, Todd will use his many years of experience in management, underwriting and problem solving to direct the daily needs of the Underwriting Department, which will include maintaining company service standards, loan quality, productivity, knowledge, training, growth and motivation. Todd will work closely with Rich and other management to provide recommendations on escalations/exceptions, process and system improvements, as well as continuing the open line of communication between Sales and Underwriting.

We have hired Conan Krueger as Regional Underwriting Manager to take over Todd’s responsibilities with the West Coast team. Todd will be working with Conan over the coming weeks to introduce him to the branches he will be working with regularly while he works with training Conan on VanDyk’s day to day systems and routines.

We are looking forward to another great year working with you all, thank you for your continued support and partnership!

As discussed on December Ops Huddle we have are opening up with a fourth Jumbo investor – Bayview Loan Servicing. The product with Bayview is an AUS driven product similar to PenFed, and VDM handles the underwriting, closing, and funding of the loan. Bayview has some qualification niches with income sources, specifically related to Asset Depletion where the guidelines are a bit more flexible than what the Agencies typically allow. Bayview is also open to looking at exceptions so if you have a scenario which does not quite fit within the guidelines, but there is strength to the file, we do have the ability to put the scenario in front of Bayview’s lending team for an exception.

Bayview’s Jumbo AUS guidelines overview are available in Howee and you are able to price loans in Optimal Blue.

We have been super fortunate for a few years now with a rate market that has been steadily decreasing and stable. Given expectations of the market for 2021 and how volatile the rate market has been to start the year, we would like to remind everyone of HPML requirements.

To know if a loan is HPML or not you need to carefully review your MAVENT reports for the HPML messages, particularly once the loans are locked. Any loans receiving an ALERT for HPML after a loan is locked will require extra review. If you determine that the loan is HPML it is important to review it against the HPML checklist attached to this announcement to ensure that it is still eligible for closing.

HPML guidelines are appraisal driven – the loans cannot close with an appraisal waiver, the borrowers cannot waive their rights to receive the appraisal 3 days prior to closing, and 2nd appraisals could be required in the event the property is a flip (regardless of loan product type). We have a HPML training that we are making available to all Production and Operations teams so you can refresh on the tools and requirements.

For all loans closing on or after February 28th, 2022, Freddie Mac is imposing new guidance for condo reviews of all projects with 5 or more attached units, regardless of review type or waiver, regarding the existence of “Critical Repairs”. Though this guidance is temporary, it is in effect until further notice from Freddie Mac.

These guidelines are similar to guidelines recently implemented by Fannie Mae regarding “Significant Deferred Maintenance”. You can find the new guidance from Freddie here: https://my.sf.freddiemac.com/updates/guide/bulletin~2021-38

The Income Calculation Worksheet has been updated for 2022 and is attached.

It has come to our attention that a few loans were brokered to Spring EQ without charging the required compensation.

Spring EQ offers a referral option with no charge but in order to take advantage of that, the borrower will contact Spring directly and apply on their own – VanDyk is not involved in the referral option.

To broker a loan to Spring EQ, 2% LPC/BPC must be selected on all SpringEQ submissions.

Bond Program Information questions have been added to Borrower Summary -2021 Page 2. These fields will be used to collect additional bond program information prior to disclosure. Not all bond programs will require all fields to be completed. If your bond program does not require a DPA Type, bond loan amount, or bond interest rate, you may omit these fields.

If any of the below factors are present in your loan file, we will need a new payoff uploaded to the eFolder within 10 days of closing:

On Monday, 1/17 Secondary distributed an email update on LLPAs. A copy of the email is attached for your reference.

Please note the new link for Fannie Mae’s HomeView course: https://www.fanniemae.com/education This site replaces the prior Framework link.

Please note that Form 216 is only required on FHA loans.

Agency Guidelines

As a reminder, Howee is linked to agency guidelines – click Program Guidelines from the main menu to search.

We also have access to AllRegs! If you need a login for AllRegs or have any questions about Howee, please email ProductionSupport@vandykmortgage.com

* * *

Sarma – Meridian Link & DU

When you change your credit password, don’t forget to update the password on the DU order screen as well.

Failure to update this will result in incorrect login attempts, which may cause your Sarma account to be locked out. Reach out to Production Support with any questions.

December 16, 2021

In an effort to support affordable homeownership we are expanding our financing options to include Singlewide Manufactured Housing as part of our product offerings for Conventional and FHA loans. Updated matrices are attached. As a reminder, all product matrices are available by asking Howee or by clicking here.

Highlights of the expanded offering:

Now that Howee is active, we will be phasing out Vamba (AskVanDyk). All matrices, cheat sheets and other resources will be maintained in Howee. Underwriting escalations will also be handled via Howee (see page 5 of attached user guide). On December 31, Vamba will be turned off. The Howee user guide is attached – please reach out to Production Support if you have any questions about using Howee.

This past summer we opened up full correspondent Jumbo lending with Chase and Pentagon Federal CU. Since then, we have closed 30 loans for just shy of 29MM. We would like to thank all of the branches who have been able to sell the loans, and Kelly Sherwood for doing a great job with underwriting and making sure these are all purchased off by the Investors. With this volume on our resume now, we are gaining approvals with new Investors which we are excited to release in Q1 next year. The new Investors will offer us expanded eligibility for the borrowers to continue to grow this segment of our business.

Effective immediately, we have terminated our relationship with Greenbox. If you need assistance locating a broker partner for a particular scenario, reach out to Production Support.

Employment Related Asset Accounts

Employment Related Assets Fannie FAQ. This discusses when a distribution from a borrower’s retirement assets or employment-related assets may be used as a source of income when qualifying a borrower.

Click Start Challenge to begin!

(wait a moment for the newsletter to display – or scroll down to download!)

Click Start Challenge to begin!

(wait a moment for the newsletter to display – or scroll down to download!)

Click Start Challenge to begin!