- Lightning Closings Are Here!

We are pleased to announce our new Lightning Closing Procedure will being going live next week! Here is how it will work: Submit your Closing Request as soon as your CD is issued – your file doesn’t need to be in Resubmittal or Clear to Close status. As long as your closing request is submitted 48 hours prior to your requested ECD, you are on track to hit your closing date. Once your loan is Clear to Close, your closing package can be delivered to title in as little as 4 hours!

We will be updating the existing “Closing Request – VDMC” form in Encompass with the Lightning Closing Process. You will use this form to submit your closing requests as shown below.

To submit your closing request, all blue fields must be completed. If any fields are missing, you will be met with an error message specifying which fields need to be completed. These fields are required to allow your Closer to begin accurately working your file for closing, even if it is not yet CTC. If this information is inaccurate, it may delay your Lightning Closing.

Once your Closing Request has been submitted, you will receive email confirmation that it has been received.

Closing Requests submitted within 48 hours of your closing date will trigger a Severe Weather Alert. These Severe Weather Alerts will be treated like our current rush requests, the Closing Department will make every effort accommodate the closing date but turn times may not be guaranteed.

If your file is not ready for closing and the closing date must be extended, please update your Closing Date Requested with your new closing date and communicate this change with your Closer. If no new closing date is known, please remove your Closing Date Requested and resubmit when a firm closing date is identified.

Communication is key. For us to achieve Lightning Closings it will take a team effort from each VDM team member that touches the file.

- aiUnderwriter

We are a full 2 months into Beta Testing the ai Underwriting tool with our Underwriting Team! aiUW was launched to our Processors at last month’s Processing Roundtable and more recently to our Regional Sales Managers, Branch Managers, and Loan Officers. We officially have {most} hands-on deck. As a reminder, this is a tool that we will continue to build and customize to what we need to enhance our VanDyk Mortgage teams and processes; all feedback is continued to be welcomed. We have BIG things coming with enhancements specific to our Loan Officers that you won’t want to miss – Stay Tuned for more information. If you or your team would like additional training with using ai Underwriter and help with how to fit this into your process flow, please reach out to Lindsey and Megan.

- New Down Payment Assistance Provider: Lakeview

We are pleased to announce that Lakeview has launched a DPA product that offers up to 4% of the lesser of the appraised value or the purchase price, with no maximum cap. The second mortgage is due and payable upon sale, maturation, refinance, early payoff of the first mortgage, or transfer of the property. The 2nd mortgage has interest only payments based on the interest rate of the first mortgage.

- Eligible States: AK, ND, AL, HI, IL (other than in Cook County which is not eligible), IN (other than in Allen, Kosciusko, LaGrange, Marion, Steuben and Wabash Counties which are not eligible), KY, MA, MD, MI, MO, MS, MT, NJ, SD, TN, & VA

A Product Overview and Matrix are attached. Lakeview will be hosting a training on July 19 at 2pm Eastern – please register at this link to attend: https://www.lakeviewcorrespondent.com/event/lakeview-national-training-2-3-pm-et-2/

- Jumbo Updates: Truist

Truist has re-entered the Jumbo space in an aggressive fashion for Delegated clients. Earlier this month, we obtained our Delegated Underwiring approval with Truist and they have been added to the Jumbo pricing options In Optimal Blue. Attached is an updated Jumbo comparison sheet.

- Appraisal Transferability Updates

We are absolutely THRILLED to announce that as of today, we will be able to accept transferred appraisals on conventional loans! The appraisal and XML file should be emailed to Amber Workman (aworkman@vandykmortgage.com) as soon as received from the prior lender so we can ensure the report is run through the UCDP. Once completed, Amber Workman will upload the appraisal to your Encompass file and mark as “Ready for UW”. The appraisal will be reviewed when the file is submitted to underwriting like usual (either as an initial underwrite or with your conditions). If the underwriter determines the appraisal is unacceptable and cannot or should not be used, a new report will need to be obtained by VanDyk mortgage through the usual process. Please find attached our updated transferability cheat sheets as well as updated Appraisal Expiration Cheat Sheet.

- Income Calculation Worksheet: Update

Beginning August 1, all teams will be using the Income Worksheet – LTK form in Encompass instead of the Excel income calculation worksheet. For an overview of this worksheet, watch this training video. If you have any questions, reach out to ProductionSupport@vandykmortgage.com

- Fannie Mae Updates

SEL-2022-06 (Attached) was issued by FNMA July 6, 2022 to include changes to the following:

- Compliance with Address Confidentiality Programs adding additional requirements for sellers/servicers to comply with state laws (must comply by Sept 1, 2022)

- When an existing manufactured home is being sold to a consumer by a builder, developer, or manufacturer as part of a new or existing MFH subdivision, the LTV ratio will be based on the lower of:

- the sales price of the MFH and land, or

- the current appraised value of the MFH and land

- Freddie Mac Updates

Review the link for video of Selling Guide Bulletin 2022-15: Guide Bulletin 2022-15 (freddiemac.com) Updates Include:

- Effective for Mortgage with Loan Product Advisor (LPA) initial submission dates on or after July 10, 2022, enhancements were made to include a First-Time Homebuyer’s rent payment history in its credit assessment, providing expanded opportunities.

- Seller must submit to LPA the current monthly rent amount paid by the Borrower AND

- Obtain a verification report of the depository account(s) from which the Borrower makes their rent payments (see details for acceptable third-party sources).

- The history will be included in the Loan Product Advisor credit assessment when the following requirements are met:

- The Mortgage is a purchase transaction Mortgage secured by a Primary Residence

- At least one Borrower with a rent payment history must:

- Have a usable Credit Score, as determined by Loan Product Advisor

- Be a First-Time Homebuyer who intends to occupy the subject property as their Primary Residence, and

- Have been renting for a minimum of 12 months with a monthly rent payment of at least $300 that is paid from the depository account(s) in the verification report obtained by the Seller

- The history will be included in the Loan Product Advisor credit assessment when the following requirements are met:

- Clarification regarding Manufactured Homes with Affordability Seconds (Section 5703.3) that the MFH must be:

- 1-unit Primary Residence

- Mortgage must be a Home Possible Mortgage

- If the MFH is in a condo project, guide requirements in section 5701.5(f)91) through (f)(5) must be met.

- FHA Updates

Please see this link for updates https://www.hud.gov/sites/dfiles/OCHCO/documents/4000.1hsgh-062022.pdf – here are some highlights:

-

- Full access letter for joint bank account eliminated

- Income Calculation Exception Due to COVID-19 Related Economic Event (for TOTAL & Manually underwritten loans) – Applies to W2 wage earners and Self-Employed.

- Gaps in Employment (for TOTAL & Manually underwritten loans) – We can now consider the borrower’s income if the borrower has been in the same line of work (not current job) for at least 6 months at time of case number assignment AND a 2-year work history verified prior to the gap. See the attached Income Guidelines cheat sheet for additional information.

- Revised Appraisal Validity Periods – Initial Appraisal extended to 180 days; Appraisal update extended to 1 year; 30-Day optional extension removed

- VA Updates

VA Circ 26-22-10 – The United States Space Force (USSF) is now considered as a branch of service; Certificate of Eligibility (COE) enhancement

Current and discharged members of the USSF or USSF Reserves, otherwise known as Guardians3, may be eligible for VA home loan benefits upon meeting length-of-service (LOS), and character-of service (COS) requirements. Qualifying Surviving Spouses of Veterans who served in the USSF may also be eligible for the VA home loan benefit

VA Circ 26-22-12 – Certificate of Eligibility Funding Fee Status Update

VA is introducing a funding fee status to inform lenders when the VA Form 26-8937 has been received and the pre-discharge or memorandum rating request is in process. Upon receipt of VA Form 26-8937, VA will conduct research to see if the Service member has filed a pre-discharge claim.

- If the Service member is eligible for the home loan benefit and VA records indicate the Service member does not have a pre-discharge claim pending, VA will annotate the COE record and issue the COE with a funding fee status of Non-Exempt.

- If the Service member is eligible for the home loan benefit and VA records indicate the Service member’s pre-discharge claim has been adjudicated, VA will update the COE with the appropriate funding fee status and issue the COE.

- If the Service member is eligible for the home loan benefit and VA records indicate the Service member has a pre-discharge claim pending that has not been adjudicated, VA will submit the rating request to the Veteran Service Center (VSC). VA will update the COE funding fee status to Non-Exempt – In Development and issue the COE. The Service member is not exempt at this time. If a proposed or memorandum rating is not obtained, and the loan closing takes place before the Veteran is discharged from service, the funding fee exemption does not apply, and the Service member will not be entitled to a refund. VA will update and reissue the COE as appropriate based on the response received from VSC.

VA Circ 26-22-11 – Pest Inspection Fees and Repair Costs

Effective immediately, VA is authorizing in advance, as a local variance, that Veterans may be charged wood destroying pest inspection fees, where required by the NOV. Veterans may also pay for any repairs required to ensure compliance with MPRs. Veterans are encouraged to negotiate the cost of the wood destroying pest inspection and repairs with the seller.

- 4506C – Clean Form Requirements

The IRS is changing how transcript orders will be accepted and processed. For VanDyk Mortgage to be compliant, we have updated our initial disclosure and closing packages to include several 4506C forms per borrower. Each form is slightly different to minimize the need to go back to the borrower(s) for multiple revisions later. If corrections or revisions of the 4506C form are needed, they should be sent as one-off docs for borrowers to E-sign.

You can minimize the need for revisions and corrections by confirming with your borrowers, prior to requesting the disclosures, what name and address they used to file their most recent federal tax return under and completing the REQUEST FOR TRANSCRIPT OF TAX form in Encompass to match these details.

- Update – Reverse Mortgages In House

We are making excellent progress towards moving our reverse mortgage loans out of the broker world and back in house. More information will be forthcoming. If you have a reverse mortgage and have not yet been contacted or need assistance, please reach out to Kristine Kuss in the Production Support department (kkuss@vandykmortgage.com or productionsupport@vandykmortgage.com)

- More Good News – Coming Soon!

- NonQM Options – Bank statement and DSCR options through Bayview

- Buydowns – Actively working on a 2/1 buy down solution

- Mid-Year Look Back

We are halfway through 2022 – here’s a recap of some of the highlights in the first half of the year:

|

|

- Upcoming Events and Reminders

If you need an invitation to one of the Zoom meetings, please respond to this message.

- Iron Sharpens Iron – Tuesday, July 19 at 11am

- Ops Huddle – Thursday, July 21 at 1:30pm Eastern

- Production Roundtable – Wednesday, July 27 at 1pm Eastern

- 35th Anniversary Events – see attachment for more details!

- August 10, 2022 | 35th Anniversary Dinner

- August 11, 2022 | Annual Golf-N-Give

- September 10, 2022 | 35th Anniversary Dinner – President’s Club

- October 8, 2022 | Ops Fly-in 35th Anniversary Meet and Greet

- March 2 – 4, 2023 | Annual Sales Fly-in

- July 1 Improvements: Reminder!

As of July 1, the following improvements are active:

-

- Introduction of Income Worksheet – LTK within Encompass (Click here for a training video if you missed last month’s Round Table)

- Patriot Act Information Form AT closing Only for Title Agent to complete

- Homeowners Insurance Reverification Form is no longer required

- Excessive Runs LOE will only be required if there is a RED Flag on the AUS

- Loan Duplication – Updated Template

When Pipelines duplicates files for you, the VOM will now copy over to the new file! We hope this makes restarting a file a little easier.

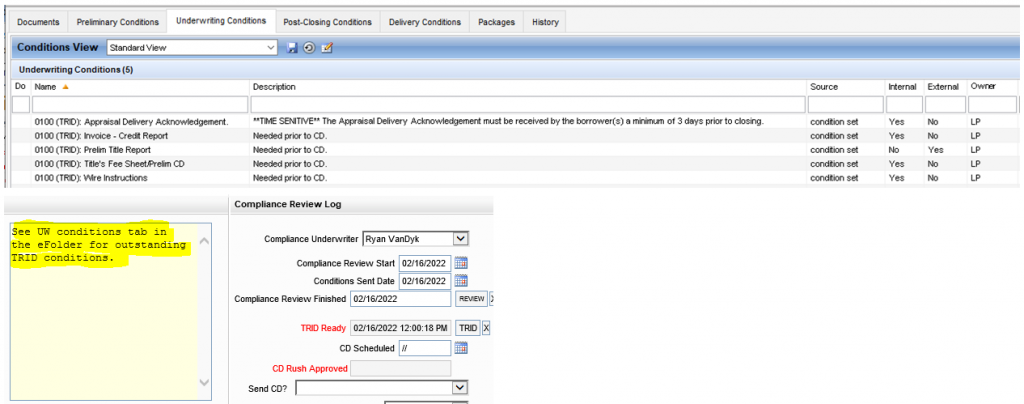

- COC/CDs – Disclosure Automation

We will soon be expanding our disclosure automation to include Change of Circumstances (COCs) and Closing Disclosures. If you are currently sending your own initial disclosures through Disclosure Desk and would be interested in sending your own COCs and CDs, please contact compliance@vandykmortage.com to schedule your training.

25 Points