Topics in the Announcement

November 15, 2021

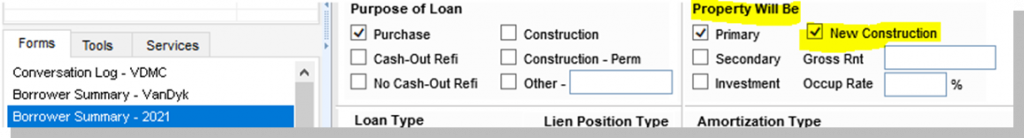

- Aggregate Setup Automation

In order to further streamline the disclosure setup process, we will be implementing new automation that will pre-set the Aggregate Adjustment upon SAVE when aggregate is empty (due date #1 is empty). Once the aggregate is complete (due date #1 is not empty) it will be fully editable by the branch to make any required changes prior to disclosure. This automation is designed to set the due dates and collect the correct number of months for escrows, not to set the monthly amounts needed for PITI. The branch will still need to ensure the total annual amount of taxes and insurance (in PITI) is correct prior to disclosure.

Below are examples of what will be pre-populating upon SAVE if the aggregate is blank. Please note the due dates will change based on Subject Property State, first payment date, and Purchase Vs. Refi.

Property Taxes:

Due to the differences between each state the property tax automation will be limited to Florida and Michigan during the initial roll out. We will be expanding to additional states as soon possible.

- For Florida, the tax due date will default to 11/1 in the Tax column.

- For Michigan, winter taxes will default to 12/1 in the Tax column and City Taxes to 7/1 in the City Tax column.

- **Please remember to break out these taxes appropriately to avoid a miscalculation when setting up your file for disclosure**.

Hazard and Flood Insurance:

Insurance will populate differently depending on if your file is a purchase or refinance.

- Purchases will default to collecting 3 months of HOI (and Flood if required) upfront in the aggregate.

- Refinance will default to collecting 6 months of HOI (and Flood if required) upfront in the aggregate.

Mortgage Insurance

12 “1s” will populate (upon SAVE) if monthly PMI is present and will remove (upon SAVE) if monthly PMI is blank.

- Coming Soon: Optimal Blue

We have made the decision to switch pricing engines to Optimal Blue. For those who have been here for over two years, this is a return to Optimal Blue. Beginning December 1, Optimal Blue will be the only active pricing engine for new lock submissions. Please see attached PDF for full details, including training information.

- RefiNow & Refi Possible: Updates

Updated matrices for the RefiNow and Refi Possible products are attached, removing 2-4 unit properties from the eligibility matrix. Only 1 unit properties are eligible for the program.

- Coming Soon: ValueLink AMS

Effective December 1, 2021, we are migrating our Appraisal Department Software to ValueLink Software. Valuelink utilizes Encompass API integration and is the first appraisal software vendor to go live with Encompass on the Web. The workflow is same as our current vendor (Mercury) but you will see a more modern look and feel. Some other benefits are that documents and data will automatically download into Encompass without needing to “pull it in.” You will also be able to request a payment link be sent to the borrower yourself after the initial order. In addition, when you’re ready to send the appraisal to the borrower, you can from Encompass and not request the Appraisal Department to do so.

Attached is a guide on how to use this new platform, and on November 15th you will receive your credentials (should be your Encompass ID). We will schedule a couple training sessions over the coming weeks. The system is live – we have processed over 50 orders so far, so you can start utilizing it anytime – but be careful not to duplicate orders. On December 1st, all orders will be required to be placed via Valuelink.

- New Documentation and Restrictions on All Fannie/Freddie Condo Project Reviews

In light of the collapse of the Champlain Towers South Condo in Florida, Fannie Mae has published Lender Letter (LL-2021-14): Temporary Requirements for Condo and Co-op Projects (https://singlefamily.fanniemae.com/media/29411/display). The letter outlines new requirements for condominium reviews as pertains to “Significant Deferred Maintenance & Unsafe Conditions”. Though this guidance is “temporary,” there is no published end date for these new requirements.

Effective immediately for all condo projects with 5 or more attached units Condo Dept will be required to further look into, and document, “significant deferred maintenance & unsafe conditions”. This will apply whether or not there is any evidence of litigation, regardless of review type, and will apply to Freddie Mac as well. Please refer to the attached memo and Fannie Mae Lender Letter for further details.

- VA Updates: Effective December 1

VA has increased appraisal fees and extended timeliness requirements in some markets. Several counties across the nation have been identified as High Demand Counties, in which the increased demand for appraisal services has created shortage of available appraisers. Appraisal fees have been increased in these counties to reflect the increased demand. In addition, all re-inspection fees are $150. Please see the attachment for details and to review the states/counties impacted by this update.

- Updated Mortgagee Clause

As a reminder: the mortgagee clause for insurance(s) only has been changed, effective 11/1/21. See attached Servicing Update for full details.

VanDyk Mortgage Corporation

ISAOA/ATIMA

PO Box 1942

Carmel, IN 46082

- Loan Templates

In order to ensure the correct loan templates are being applied to each new loan, we will be removing the old pre-URLA 2020 templates from Encompass. Currently, the majority of users are applying the new ULRA 2020 templates correctly and should have no impact from this change. However, if you are still using the pre- URLA 2020 template sets and would like it converted to any closing cost data please reach out to production support for assistance.

Helpful tip for files with co-mortgagors!

To easily identify the number of borrower pairs/Co-mortgagors on a file, we encourage you to add the “Number of Borrower Pairs” column to your pipeline view.

We have added a pipeline highlighter rule that will turn anything greater than 1 pink.

November 2021 Lending Announcement

Click Start Challenge to begin!