August 15, 2022

- Appraisal Options: UpdateWe are excited to announce that VanDyk Mortgage has been invited to participate in pilot programs for both Freddie Mac and Fannie Mae for increased modern appraisal options. It is IMPORTANT that on conventional single-family homes (including those with ADU’s) to run both AUS upfront to make sure you get the quickest, best appraisal option to utilize these tools. See details in the Conventional Appraisal Flexibilities document

- Reverse Mortgages

We are a GO people! Reverse mortgages are now available in-house and will be proceeding as a Principal Agent. We have completed these transactions in the past but our new set up is different than before and as a result, everyone will be required to go through a refresher with our reverse team before access to Reverse Vision will be granted. Details are attached. Reach out to a member of the Reverse Team: Sophie Morales (smorales@vandykmortgage.com), Adam Wilson (awilson@vandykmortgage.com), Kristine Kuss (kkuss@vandykmortgage.com) or Production Support should you need additional assistance.

- Bank Statement Program – New In-House Option

We are pleased to offer another Retail solution for the Bank Statement loans through Bayview. These loans will be a hybrid process for underwriting and closing where Bayview will do the underwrite and VDM will handle the closing. Offering another Retail option will provide more pricing and guidelines options to our borrowers.

- Loans in MA, CT, NY, UT, HI, MO, NV are not permitted

- Texas 50(a)(6) not permitted

Any questions can be directed to nonQM@vandykmortgage.com. Please refer to the attached Pricing Guide for tips on pricing these loans in OB. A new Process Flow for Bank Statement loans is attached as well, along with NewRez and Bayview program overviews.

- FHA Buydown Options

We are excited to offer 2/1 FHA buydowns effective today, 8/15/22. A 2/1 buydown is going to reduce a borrower’s interest rate 2% in the first year, 1% in the second year, and then the note rate the following 28 years. We will be offering both lender and seller funded buydown options. Buydown matrix is attached for your reference.

In Encompass, you can select the “FHA 30 Year Fixed 2/1 Buydown” loan program. Upon selection of this loan program, the buydown information will automatically be input to the loan.

On the Reg-Z CD form within Encompass, you can click the Buydown Disbursement button to see the full details and determine the buydown amount that will need to be collected.

- Production Support: Department Update

We are pleased to announce the addition of Alex Green to the Production Support team! Alex has experience in VanDyk’s underwriting division as both a Jr Underwriter and a Condo Review Specialist, and we are delighted that he has joined the Production Support team. Please be sure to email productionsupport@vandykmortgage.com or complete a support ticket should you need assistance. The Production Support menu of services and other details is attached.

- Self Employed Income Review Team: Update!

Our Self-Employment Income Support Team is now reviewing/calculating rental income! Feel free to submit your file for review for your borrowers with rental income. Attached is a reminder on process flow and required documentation.

- SSA-89 Forms – Now Available to Be eSigned

The wet signed SSA form has been removed from the initial disclosure pack in SimpleNexus as it can now be e-Signed. You can also request the SSA form be eSigned as a one-off document if you need to validate a SSN and do not have a wet signed SSA form. Please reach out to ProductionSupport@vandykmortgage.com with questions.

- New UDM Requirements

Effective immediately, UDM will be required for all files with a DTI of 40% or higher. Due to audit results where undisclosed debts were present, DataVerify is requiring a revision to our UDM policy. Any new fraud report pulled today where the DTI is 40% or higher, UDM will automatically be turned on. We will accept a soft pull in leu of a UDM report (sometimes there is an issue with the UDM request vs. ECD time frame). Contact Production Support for assistance with soft pulls if needed.

- Loan Comparison Tool (LCT)

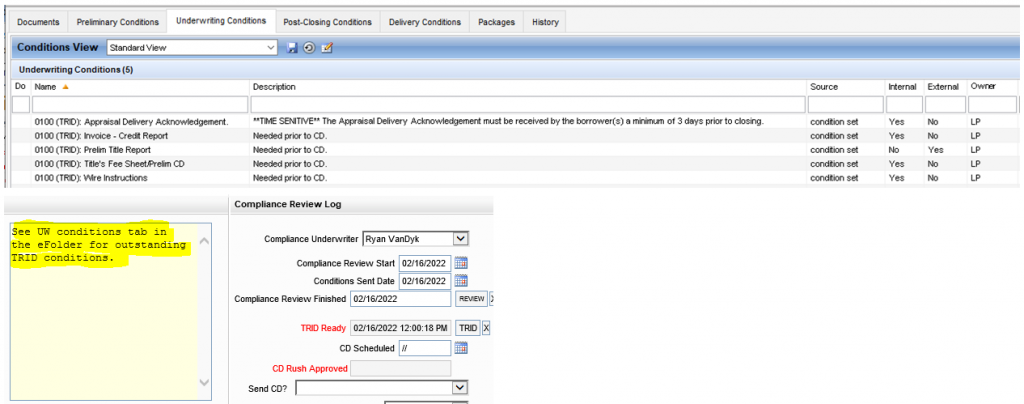

An updated Loan Comparison Tool has been added to Encompass to assist in tracking changes in a loan file. This tool compares current loan data to data sent on the last set of disclosures. Any discrepancies in the tracked data will trigger the below alerts in encompass. The alerts will clear once a new LE or CD is sent on the file.

-

- Zero Tolerance Fee Increase (LTC) – Triggers on an INCREASE of zero tolerance fees, which likely have a 3-day window to disclose.

- Data Discrepancy (LTC) – Triggers on any change of the tracked data.

- ATR/QM Alerts

In addition to the LCT alerts, we would also like to highlight the ATR/QM alerts. These alerts MUST be resolved prior to closing and typically require additional lender/seller credits or a pricing adjustment to resolve.

-

- Pricing Exceeded = Your current APR is over the allowed threshold over the APOR. APR must be lowered.

- Points and Fees Exceeded = Your fees exceed the ATR/QM threshold and must be lowered.

- Branch Disclosures: Initials

With the implementation of the Disclosure Automation (Disclosure Desk – VDMC) and the Loan Comparison Tool, we will be moving toward branch generated initial disclosures in the coming weeks. This workflow will allow branches to issue their own initials disclosures quickly and easily without a required second compliance review on each file.

-

- This will be rolled out on a region by region and will be coordinated through your Reginal Manager. More information to come!

- Broker Process Update: Effective September 1

Due to industry changes and product demands, we have revised how we are managing the broker process at VanDyk mortgage. These changes will go into effect for loans approved to broker on or after September 1st – watch your email for training invitations coming soon!

Update: Lightning Closings

The Lightning Closing workflow has been a huge success! We have seen an increase in closing efficiencies, a decrease in turn times, and have received rave reviews for all parties involved. Below are some changes and reminders to help keep this workflow running smoothly.

- Updated Hyperlinks for Manufactured Homes, POA/Trust, and Final VOEs

- VOE override for SS income and/or no income loans. (Coming Soon)

Reminders:

-

- Please keep your Closing Date Requested as updated as possible.

- Utilize the Closing Notes for any special instructions for your closer.

- Clear to Close is not required to submit a closing request. Please submit once the following is met:

- A CD has been issued.

- Final VOEs have been completed (typically within 10 days of closing).

- In House vs. Non-Delegated vs. Brokered: A Quick Explanation

- In-House: VanDyk Mortgage handles the process of the loan file from application through closing and funding. LO compensation is not disclosed to the borrower on the CD

- Non-Delegated: VanDyk Mortgage handles all but the underwriting of the loan file. The loan is priced and locked in OB and the comp plan is set up the same as your regular conventional in-house plans. The loan closes and funds in VanDyk Mortgage’s name. LO compensation is not disclosed to the borrower on the CD.

- Broker: Our Broker Partner handles all but the processing of the loan file. The loan closes and funds in the Broker Partner’s name. LO compensation is disclosed to the borrower on the CD.

| In-House | Non-Delegated | Broker | |

| Disclosures | VanDyk Mortgage | VanDyk Mortgage | Broker |

| Underwriting | VanDyk Mortgage | Investor | Broker |

| Closing | VanDyk Mortgage | VanDyk Mortgage | Broker |

- Agency Update: Fannie Mae

Highlight(s) from the Fannie Mae Selling Guide Update SEL-2022-07 (08/03/2022): Final Verbal Verification of Employment Alternative

Our current policy requires a verbal verification of employment (verbal VOE), written verification, or a third-party verification report within 10 business days prior to closing to verify employment for borrowers who are not self-employed.

We updated the Selling Guide to add an alternative to satisfy the verbal VOE requirement for non-DU validation service loans. With this updated requirement, the lender

- may use an email exchange with the borrower’s employer within 10 business days prior to closing to verify employment;

- must conduct due diligence to confirm the email address for the employer is accurate;

- and must ensure the email is from the employer’s work email address and includes the borrower’s name; name, title, and work email address of the individual contacted at the employer; date of contact; and borrower’s current employment status.

Effective: Lenders may begin using this verbal VOE alternative immediately. DU will be updated the weekend of Aug. 20, 2022, to support this policy change.

- Agency Update: Freddie Mac

Highlight from the Freddie Mac Bulletin 2022-16: Selling (08/03/2022): AIM Income Offerings – Partial Income Representation and Warranty Relief

Partial income representation and warranty relief (formerly referred to as source level representation and warranty relief) is granted when multiple income sources are submitted through Loan Product Advisor and one or more of the income sources receive income representation and warranty relief, but additional sources of income are required. In these instances, the income that is not granted representation and warranty relief must be documented in accordance with the Guide.

With these changes:

- A Loan Product Advisor feedback message indicating partial income representation and warranty relief has been added

- Loan Product Advisor feedback messages have been updated to provide representation and warranty relief details specific to each income source submitted

- Loan Product Advisor feedback messages will be specific and actionable

Each income source will still be considered for representation and warranty relief eligibility through Loan Product Advisor as it is today.

- Agency Update: VA

VA has issued CIRC 26-22-13 allowing for Alternative Valuation Methods, Exterior-Only and Desktop Appraisals, for PURCHASE transactions where all of the following are true:

- Purchase Price does not exceed the current calendar year conforming loan limit for the property jurisdiction.

- The dwelling is a single family (1-unit) home that is not a manufactured home or condominium, not located on a leasehold estate, and not undergoing renovation.

- One or both of the following: The Veteran is making a down payment of at least 20% of the purchase price OR more than 7 business days have elapsed since the lender requested an appraisal and the case remains unassigned in VA’s system.

Attached are also Exhibits A & B outlining the Appraisal Assignment Waterfall and Appraisal Report Supplemental Information.

VA Manufactured – We are lifting our overlay on Singlewide Manufactured Homes. Attached is the updated VA Fixed Rate Matrix removing singlewides as ineligible.

- Coming Soon: New Marketing Platform!

Introducing Total Expert at VanDyk Mortgage, a CRM system to create growth and loyalty for Loan Officers.

Total Expert offers the industry’s only platform with CRM and marketing built together from the ground up. Design and deliver a better customer experience from the first contact and increase overall production by an average of 20%.

With Total Expert, you can create and deploy campaigns in multiple channels-including print, direct mail, social, SMS, and email marketing to meet consumers in the channel that they prefer. Total Expert will have integration points with the rest of the technology stack including Encompass, Optimal Blue, and SimpleNexus to drive hyper-personalized marketing efforts.

The implementation work has started – you can anticipate a roll-out of the tool in Q4 of this year. More detailed information on timelines will be available soon.

- Upcoming Events and Reminders

If you need an invitation to one of the Zoom meetings, please respond to this message.

- Iron Sharpens Iron – Tuesday, August 16 @ 11am Eastern

- VanDyk Mortgage Newscast (Formerly Ops Huddle) – Thursday, August 25 @ 1:30pm Eastern

- Production Roundtable – Tuesday, August 30 @ 1pm Eastern

35th Anniversary Events

- September 10, 2022 | 35th Anniversary Dinner – President’s Club

- October 8, 2022 | Ops Fly-in 35th Anniversary Meet and Greet

- March 2 – 4, 2023 | Annual Sales Fly-in

Joint Applications – Reminders/Updates

As a reminder, unmarried borrowers may be on a joint application in Encompass (unless it is a VA). Joint borrowers need a joint credit report for AUS to run.

Please keep in mind – if we have a multiple borrower file, the “joint” pair should be reserved for spouses/couples/partners. (Example: if a married couple is signing with their child, the child should not be joint with one of the parents.)

* * *

Reminder: Suggestion Box

Do you have an idea to improve our workflow, or a change in Encompass that you would like to see and will also help your colleagues? We want to hear from you!

The Suggestions Inbox is LIVE and available to everyone at https://suggestionsbox.vdmc.net/

Please submit your ideas! Suggestions are reviewed weekly by management and we are looking for suggestions with 5 or more votes. Any suggestion implemented as a business improvement that was upvoted by peers or accepted by management will win a $50 gift card.

25 Points