Topics in the Announcement

- Texas Attorney Submission Procedure Revised

Closing Department will now allow the submission of closing docs to the Texas attorney to take place at the Resubmittal Milestone if the following conditions are met:

- TRID has been cleared.

- Closer is Assigned.

- All required documentation is in the file (See attached TX Attorney Submission List).

- Closing Date and Loan Amount have been confirmed with all parties.

- Attorney Docs are Closing Date and Loan Amount sensitive. Changes after initial submission will require re-submission and updated attorney docs, which may cause delays.

- Texas and Arizona Bond programs now available

We are pleased to expand our bond programs to include Arizona Industrial Development Authority (AzIDA), and Texas Department of Housing and Community Affairs (TDHCA).

Attached please find the Bond Program Lock Sheets for both programs. Also attached are Bond Procedures that provide locking instructions, fee requirements , and a link to training.

- TEXAS TDHCA Bond Form – Branch

- Texas Bond Procedures

- AZ Housing Bond Form – Branch

- Arizona Bond Loan Procedures

- URLA Video

Now that everyone has had a chance to look at the new 1003 that is coming the first quarter of 2021, here is a video giving you a glance of how it is going to look and react in Encompass. https://seafile.vdmc.net/f/607e0ce2c831455cbe10/?dl=1

- Transcript Cheat Sheet Revised

Information added that business tax returns are not required unless they have been amended. Additionally, tax returns that are amended (personal or business) are not accepted after the application date. 2020 Tax Return and Transcripts Cheat Sheet REV NOV 2020

- COVID-19 Guidance for Self-Employed Borrowers

Based on recent updates from the Agencies, we have revised our COVID-19 guidance for self-employed borrowers as follows – Three (3) months business statements are required with new submissions to underwriting on or after 12/14/2020. Covid – 19 Guideline Clarification and Product Updates Nov 2020

- Section 184/Native American Trust Land loans are discontinued effective immediately

First Tribal is no longer offering this program. We apologize for any inconvenience this may cause.

- Insurance Guidelines Revised

USDA allows an exception to their deductible rule of the greater of 1% or $1000 if the insurer does not offer a deductible this low. This typically will only apply to wind/hail coverage. Evidence from the insurer they do not offer a lower deductible will be required. Insurance Guidelines NOV 2020

- FEMA Lookup for Disasters

If your DRIVE Report is indicating that you property is within an area that has possibly been declared, you can determine whether or not additional documentation will be needed based on review of FEMA site. Underwriting does not rely on the DRIVE Report. FEMA websites are reviewed. FEMA Address lookup is: https://www.disasterassistance.gov/get-assistance/address-lookup FEMA Designated Areas Lookup is: https://www.fema.gov/disasters/disaster-declarations

If the county is NOT in a declared MAJOR Disaster Area, we will not need any further documentation.

If the county IS in a declared MAJOR Disaster Area and the incident date is BEFORE our appraisal, the appraisal must indicate no damage. If using PIW and incident date is more than 120 days after our application date, no appraisal or FEMA inspection required.

If the county IS in a declared MAJOR Disaster Area, and the incident date is AFTER the appraisal OR within 120 days of our application date using a (PIW), we will require an appraisal, appraisal update, or FEMA Inspection.

Group Email for Disclosure Approvals

Did you know that you can create a group email for disclosure approvals?

This is a great way to ensure everyone who needs to review a proforma LE/CD is included on the approval email from Compliance/Closing. This works well for both individual Los as well as larger teams that have the same processors, TCs, or LOAs copied on all their disclosure approvals.

If you are interested, please reach out to IT with a list of recipients you would like included. This new email address can also be configured to auto populate in LE page 0/4 for all your future disclosures.

*

VA loan paying off current VA loan

Unless the closings are back-to-back, the entitlement must be restored prior to closing. Exception for up to five business days prior to current closing can be made if evidence is provided by the branch the restoration has been requested from VA.

*

CAIVRS

We do Not need a CAIVRS for a Non-Credit Qualifying FHA Streamline

*

Appraisal Waiver Form

We do not need an appraisal waiver signed for any FHA Streamline – Credit Qualifying or Non-Credit Qualifying

*

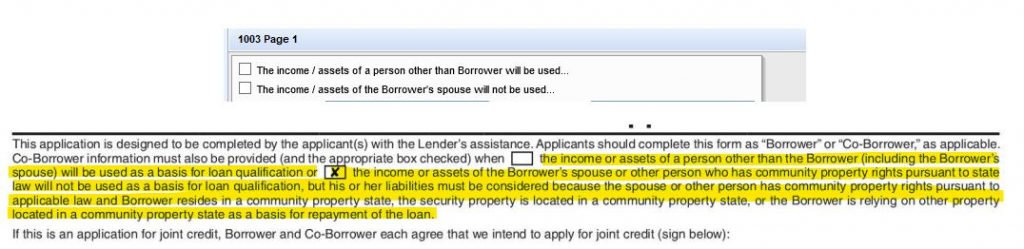

Encompass 1003 Date Entry Error

We are seeing the 1003 Page 1 regarding income/assets of Borrower’s spouse often answered incorrectly. We think this is because only a portion of the verbiage is shown in Encompass. The top box should be marked any time there is more than one borrower on the loan. The bottom box should only be marked on a Government loan in a Community Property state where we are using the non-borrowing spouse’s liabilities to qualify the borrower. List of Community Property States are available at: https://www.investopedia.com/personal-finance/which-states-are-community-property-states/

Nov 2020 Lending Announcement

Click "Start Challenge" to Begin!