Topics in the Announcement

September 16, 2021

During the weekend of 9/18/21, DU is releasing an update. Highlights include:

- Use of rent payment history in DU – this new feature will allow us to utilize a positive rent payment history to help increase homeownership opportunities for certain first-time homebuyers when the current rent payment is at least $300 and it can be identified on a 12 month VOA lookback. If you are using AccountChek to verify the borrowers’ assets and they provide information for the account used to pay their rent, this will be identified in DU and used as a positive factor when DU assesses credit risk. The great news here for processing loan files is that when you order the 30/60/90 day VOA through AccountChek, the 12 month look-back will automatically be generated and sent to DU for evaluation. The 12 month look-back sent to DU will only be scanning for regular monthly rental payments, it will not be evaluating or messaging any kind of deposit or other payment history.

- Credit score eligibility in DU – DU will now use an average of the median credit scores to open up eligibility to borrowers with less than a 620 mid FICO, applying with co-borrowers who have higher scores. Interest Rate and MI pricing will still be based on the lowest mid FICO score of the application. Currently, all our MI partners except for National will be opening up MI eligibility for scores below 620. Quoting your MI in Encompass is the most effective way to ensure the vendor you are quoting can also accept the application.

- Condo Review Request: Process Update

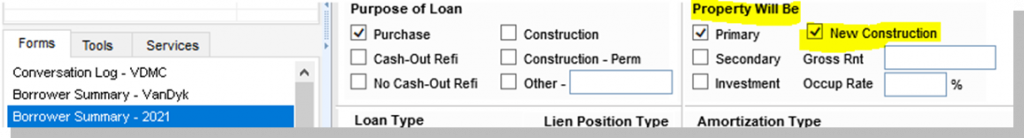

In an effort to streamline processes with the Condo Team, we will be changing the method for new order requests. Effective immediately, and mandatory beginning 10/1, all new orders for condo reviews will be placed within Encompass. New fields have been added to the Borrower Summary screen in Encompass under the Subject Property Information section.

To order a Condo Review, the Branch simply needs to input the “Condo Ordered” date, and this will then populate into the Condo team’s new order pipeline view. Condo orders will be worked First In, First Out in the order that they are received. As a reminder, HOA contact information completed in the File Contacts #61 is required to begin a condo review.

We have seen an overwhelming amount of activity with brokered loans. We are updating our procedures to clarify which services you can expect as part of VDM’s mandatory use of a centralized brokered loan point of contact, and which services are optional for a fee. Production Support will be available to assist with education and placement for any loan you are looking to broker. The “Brokered Request Form” has been fully updated with our most recent list of approved investors, along with approved product offerings for each, and important info such as mortgagee clauses, how to register, request disclosures and order appraisals.

Below is a summary of the additional services:

- Non-Optional Services required for all brokered loans:

- Secondary Approval, Registration and Disclosure

- Initial submission to the wholesaler

- QC

- Optional Services:

- Processing ($595 fee)

- Appraisal ordering

- CD Requests

- Specific Product Training

- Investor Training

As with all applications, the Branch will still retain the responsibility of sourcing the production and working with the TC/CSA to take a complete application and gather supporting documentation needed to submit a loan for processing/underwriting.

We are pleased to bring back AllRegs as a guideline resource for you. If you have previously used AllRegs with VDM, then your existing user ID and password will be active. You may also reset your password at the login page if you forgot it. If you have not previously used AllRegs with VDM, please contact Production Support and we will assist with setting up new user access for you.

AllRegs houses all of the Agency Guides as well as an “Investor Library” where you can access guidelines for PenFed and Chase. We are limited in the products we are selling with PenFed and Chase, so if you need clarification on which section of the guides is pertinent to your own research, please continue to email JumboLoanReview@vandykmortgage.com for help and questions.

The Mortgage Insurance options have been updated to account for NY state specific regulations. When this new option is selected, PMI fee rules will deactivate and allow removal of PMI – even if LTV is greater than 80%.

We have added an NY CEMA indicator to the Borrower Summary-2021 to assist with identifying NY CEMA loans. If you are originating an NY CEMA Refinance, please ensure this is marked appropriately.

This will be a required field to be completed for all NY refinance initial disclosures.

- TX 12-Day Notice – Non-borrowing Spouse/Owner – Floify

We have made recent enhancements to Floify that will allow a non-borrowing Spouse/Party/Owner to receive a copy of the TX 12-Day notice at initial disclosures.

If the below information is completed in File Contacts prior to initial disclosure, Floify will send a link to said borrower to sign the 12-Day notice on all TX Cash Out refinances or primary residences.

PLEASE NOTE: The NBS will only receive a link to this form when the 12-Day Notice is generated (i.e., at initial disclosure), if the NBS contact infomration is not present until after initials, it will be the branches responsibility obtain this signed document at least 12 days prior to closing. Please also verify all time sensitive disclosures with your borrowers to confirm they received the link provided.

- Servicing Operations: Update

Servicing Operations continues to partner with internal customers, external customers and strategic third parties to achieve exemplary customer satisfaction results. Here are some of the recent and upcoming updates:

- Property Tax: Partnered with Corelogic Residential Tax Solutions to utilize their integrated technology to ensure property taxes are appropriately paid timely.

- Since go-live in May 2021, we have expended $7.0mm on behalf of 4,778 customers nationwide with nominal issues noted for payment delays.

- Property Insurance: Effective 11/1/2021, we will partner with a private label solution to handle property insurance matters. This transition should be transparent for our customers. We are working to integrate a seamless end-to-end integrated solution to facilitate:

- Improved customer service responsiveness via phone and/or email

- Better monitoring of cancellations and forced place insurance requirements

- Timely payment processing related to 1,300 insurance invoices per month

- Customer Responsiveness: Improved customer phone call responsiveness to 86%, despite receiving 1,100 more calls per month.

- In Q2, rolled out Make a Payment video to better instruct customers on how to make their payments in the Van Dyk Mortgage internet portal. This video has been going out to all customers currently through Top of Mind.

- In Q4, we will be rolling out an automated payment option to accept payments over the phone without needing to speak with a person.

- Make a Payment call volume is 42% of the monthly volume. By automating these calls, we should be better served to increase responsiveness to 100%.

- In the past 6 months, we have doubled our staff, created a self-service portal for payoff requests, added a call center phone system, and enhanced our email hierarchy to ensure inquiries get to the right person more quickly.

- Disclosure Desk – VDMC (Coming October 1st)

We are excited to announce disclosures are getting an upgrade! LE page 0 and LE page 4 will soon be replaced with Disclosure Desk – VDMC for requesting all your disclosures, both LEs and CDs. With a combination of Disclosure Automation and Integrity Check Rules this new form will help streamline the disclosure process and increase both speed and accuracy of borrower disclosures. Disclosure Desk – VDMC will also allow branches to push their own LEs and CDs once fully deployed.

The most noticeable change with Disclosure Desk VDMC is the addition of Integrity Check rules. These rules will require certain data to be complete prior to submitting your file for disclosures, and will dynamically change depending on the loan. Required fields will appear in RED and suggested fields will appear in YELLOW.

Each Integrity Check rule will describe the issue by hovering over the Alert Icon at the top of the section. The below failure is requiring due dates for taxes and HOI since the file is not waiving escrows. It will clear once the aggregate set up is completed.

This form will be rolled out in phases:

- Phase 1 – Initials:

- Phase 1: A -Full Review – LE Page 0 (2.0) (COMING 10/1/21)

- All loans will be “Sidelined” for review when requested through Disclosure Desk. Compliance will continue to review ALL initial disclosure requests as they do currently.

- Phase 1: B – Automated Initials.

- Branches will be able to push their own disclosures automatically through the Disclosure Desk without an additional review by Compliance. Only select files will be Sidelined for review (i.e., Bond Loans).

- Phase 2 – COCs:

- Phase 2: A – Full Review

- Phase 2: B – Automated COCs.

- Phase 3 – CDs:

- Phase 3: A – Full Review

- Phase 3: B – Automated CDs.

Property Taxes – REMINDER!

We are approaching the months of the year where property taxes are coming due. This is important for us when structuring our LEs and cash to close on files. Many title companies and attorneys’ offices will begin using the estimates for what is due to establish tax proration credits, and we will also need to account for this in our escrow account set-up as well, which in turn effects the final monthly payment we use for qualification.

Please be sure that you are reviewing the most up-to-date estimates in your locality. Also be reminded that in situations where taxes or CDDs are paid for the year in advance, there is a considerable reimbursement due from our Borrowers to the Sellers on purchase transactions. This often times grossly increases cash to close over what we may have estimated – please review your LEs and escrow account set-ups carefully and make sure that your borrowers have the most accurate information up front.

September 2021 Lending Announcement

15 Points

Click Start Challenge to begin!