Topics in the Announcement

- New URLA – Coming Soon!

In Q1 2021, the new URLA Form 1003 will be coming. Please see attached memo and additional PDF previews of the new URLA sections.

- Introduction to the URLA 1.2021

- urla_borrower_information

- urla_additional_borrower

- urla_lender_loan_information

- urla_continuation_sheet

- urla_unmarried_addendum

- Phasing Out UWScenarios Email Address

On November 1, the UWScenarios@vandykmortgage.com email inbox will be phased out in favor of the AskVanDyk.com Escalation form. Questions submitted through the form will provide our underwriting leaders with additional information that can help answer your questions more efficiently. The form will also decrease duplicate tickets/emails. In addition, as we publish more answered questions, many of your inquiries may be solved with a search in AskVanDyk.

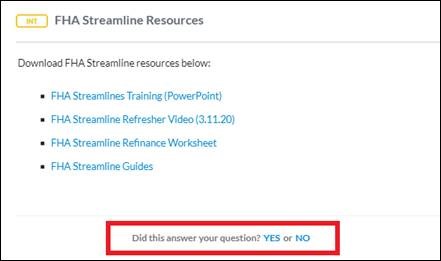

As a reminder, all pages and search results in AskVanDyk will have: “Did this answer your question? YES or NO.” Clicking “No” will allow you to escalate your question, as seen below. Please see AskVanDyk Training Guide for additional information.

If you have any questions or need login credentials for AskVanDyk, please email Production Support. Thank you!

- PMI Companies – Contract Underwriting

In an effort to provide you with the best service and underwriting turn times possible, we now have an opportunity to utilize contract underwriting for our conventional loans with mortgage insurance. ARCH, Radian and Genworth (GE) are each ready to accept files from VDM. If you have any refinances in the pipeline with PMI you can submit directly to Radian, Arch and Genworth. We will begin publishing the MI turn times on our daily e-mails.

Attached are how to guides for the 3 companies we can submit to, as well as instructions for how to work through the milestones in Encompass when submitting to PMI. (Utilizing the MI companies for Contract Underwriting) You will submit files to MI in Encompass and work the loans through CTC from the MI company. Once the loans are CTC with MI the loan will be reviewed by the underwriting team for CTC. Please email Production Support if you have any questions on the procedures or file flow.

Be advised, you will only send files to one of these 3 companies which you have pulled an MI quote for. You wouldn’t send a file to ARCH with a Radian MI quote, instead Arch to Arch, Radian to Radian and GE to GE

If you have questions or need additional assistance, please contact ProductionSupport@vandykmortgage.com.

- Fannie Mae Selling Announcement SEL-2020-06

Fannie Mae has made updates to the Selling Guide. The attached introduces significant changes in condo guidelines for condotels, provides red flags for recognizing when a project may be leasing their facilities and clarifies that the master association also must own all its own facilities, and adds that pre-litigation activity also must meet Fannie Mae litigation guidance. Updated Condo Full Review Conventional Matrix is attached, as well as a summary of the changes (Project Standards).

- Freddie Mac Guide Updates

Freddie Mac has updated their HELOC calculation options and PUD insurance verification requirements – please see attached Freddie Mac Bulletin 2020-38 for details.

- Cash Out Refinance – Credit Score Requirement Update

We are now allowing for cash out refinances to meet the Agency minimum FICO requirements. New Matrices:

- Fannie Mae Fixed Rate and ARM Conventional Matrix October 2020

- Freddie Mac Fixed Rate and ARM Conventional Matrix October 2020

USDA – CAIVRS

You do not need a separate CAIVRS if you have GUS Findings. We will use the CAIVRS that is included in GUS.

Freddie Mac LPA – Tips!

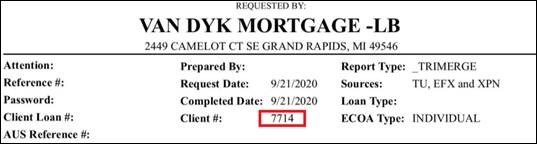

When running LP with Sarma/Network Credit Services, you will need to enter a branch code on the order screen. You can find your branch code right on your credit report:

LP requires alphanumeric credit reference numbers, so remove the hyphen from your reference number – i.e. BUEBL1234567

Floify Resources

We have compiled several Floify training videos and PDFs at AskVanDyk.com – click here to access.

As a reminder, if you need access to AskVanDyk/Vamba, email Production Support.

October 2020 Lending Announcement

Click Start Challenge to Begin!