(Wait a moment for newsletter to load, or scroll down to download a copy.)

June 2021 Newsletter

Click "Start Challenge" to begin!

(Wait a moment for newsletter to load, or scroll down to download a copy.)

Click "Start Challenge" to begin!

Topics in the Announcement

May 20, 2021

Effective immediately, you may price and lock investment and second home refinance transactions, both rate/term and cash-out. Attached please find our revised FannieMae and FreddieMac Matrices.

Starting on June 1st, you may begin submitting TBD files for FHA, VA and USDA loans that require a manual underwrite, and for all loans using income from self-employed borrowers.

Recent comments and requests for fee increases by our appraisal panel led us to review the fees we offer Appraisers when sending out appraisal assignments. We compared our fees to VA (our initial pricing model), AMCs, and recent requests for increases and we found we were low and that we need to increase our fees to remain competitive. Attached you will find the new fee chart for all orders placed after May 28, 2021 and assigned out June 1, 2021.

On the topic of appraisals, we wanted to pass along a helpful article that explains longer appraisal turn times and market conditions: Appraisal Turn Times: Can We Speed Them Up?

Lender Letter LL-2021-03 attached states that flexibilities related to verbal VOEs and POA are no longer applicable for loan applications dated on or after May 1, 2021. Standard Selling Guide guidelines now apply to these topics. You can find those guidelines here: VOE – POA

The Fiscal Year 2021 income limits for Single-Family Housing Guaranteed Loan Program were published on May 12, 2021. GUS and the Income Eligibility calculator on the Eligibility Website have been updated with the new income limits.

Effective for settlement dates on or after August 5, 2021: We will no longer be able to use tax proration credits on the 1003 for qualification purposes, therefore they cannot be reflected in the credits on the Details of Transaction. We will still be able to add these credits to the CD. Full details are attached.

Last month, we introduced a new loan folder called New Construction to help identify loans that will not be closing immediately. As a reminder, loans should remain in this folder until they are within 60 days of closing.

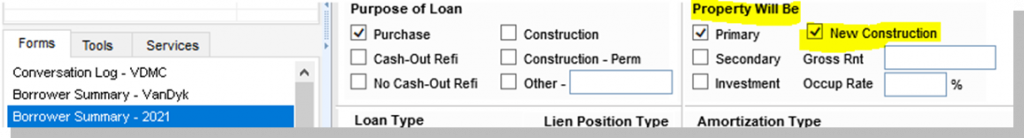

We have also added an indicator field to the Borrower Summary for you all to use (pictured below). This will help the Lending Teams identify which files in the pipeline are New Construction, and will also facilitate moving through the pipeline as purchase loans (on the occasions when the loan purpose is Refinance instead of Purchase).

We are also updating our requirements for Certificates of Occupancy and Final Inspections to be Prior to Funding items when the subject property is in a full new construction community (for example, homes built by Lennar, DR Horton, MI, etc.). It will be the branch’s responsibility to make sure that these items are received in time for funding and to notify the UW when they are uploaded for review.

Click Start Challenge to begin!

(wait a moment for the newsletter to load – or scroll down to download!)

Click Start Challenge to begin!

(wait a moment for the newsletter to load – or scroll down to download!)

Click Start Challenge to begin!

Topics in the Announcement

We will be rolling out non-delegated Jumbo loans through Truist (created through merger of BB&T and SunTrust) in the coming weeks – Loan Officers and Processors will need to complete training in order to get access to submit these loans to the investor for underwriting.

Truist’s Jumbo guidelines are available to review at https://www.stmpartners.com/Manual/cor/products/CKey.pdf – please bookmark this site for easy access, as guidelines will change periodically.

Training session invitations and information will be distributed soon!

Tax transcript/4506C forms eSigned in Floify outside the initial disclosure package are now being accepted by DataVerify! If you need a refresher, a how-to for adding Floify E-Sign docs is attached.

USDA has expanded the program for existing manufactured homes. States included in the pilot are: Colorado, Iowa, Louisiana, Michigan, Mississippi, Montana, Nevada, New Hampshire, New York, North Dakota, Ohio, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming. Please see the attached USDA Memo for eligibility conditions for this program.

Starting Monday May 3rd North Carolina Housing Finance Agency (NCHFA) loans can be originated. Please note, NCHFA requires that the LO is located in North Carolina – otherwise, they will have to refer the loan to an originator in NC.

Please see the NCHFA Launch attachment for additional information. Lock form is also attached. Additional resources and guidelines are available at https://www.nchfa.com/homeownership-partners/lenders/forms-and-resources

When refinancing a mortgage through VanDyk, the payoff must be dated within 10 days of closing. As a reminder, you can email ServiceMyLoan@vandykmortgage.com for payoff requests.

To roll escrows over to the new loan, the signed Escrow Rollover Agreement must be sent to the Servicing department with the payoff request. When escrows are rolled over, any refund due to the borrower for their existing escrow account will be applied to their principal balance instead of refunded to them after closing. The Escrow Rollover Agreement form can be printed from Encompass.

When entering property addresses, please do not abbreviate or shorten any city names. It is acceptable to abbreviate street suffixes such as St, Ave, or Blvd.

First, the Mercury product list has been updated to include “Est Value UNDER $750,000” and “Est Value OVER $750,000” for Conventional SFR and Conventional Condo options. The price list has been updated and is attached.

Second, Mercury is implementing a change that will affect email notifications on or after April 21, 2021. To protect borrower privacy, the name of the borrower will be replaced by the word “Borrower” in email notifications sent from the platform. In addition, if the email subject line contains the borrower’s name and the email body contains the loan number, the email subject line will be replaced with the subject property’s physical address.

The Homeowners Insurance Deductible for NM Housing cannot exceed the lesser of 1% or $1000.

Cryptocurrency must be documented like any other market-based asset, and is acceptable for use as an asset with Conventional financing. AccountChek is the best option to document these accounts whenever possible.

Starting May 1, any emails sent to URLATeam@vandykmortgage.com will automatically forward to the Production Support mailbox. We appreciate all the questions and feedback we received in March and April!

VA Refinances – Initial Disclosures

As a reminder on VA refinances, information must be completed prior to the initial disclosures being requested.

The Cash Out Refinance Tab needs to be filled out with the existing loan and proposed loan figures as well as the selection of one or more benefits.

Estimated figures are allowed for the initial disclosure but must be finalized for the closing package.

Also, the Qualification Tab will need previous loan info as well as:

Topics in the Announcement

March 18, 2021

We can now help with your lien searches on free and clear properties. To request a lien search, please email Production Support with the borrower name and loan number.

Attached is a copy of the new FHA Single-unit questionnaire. It can be used immediately, but mandatory for case numbers assigned on or after May 17, 2021. The attached Mortgagee Letter explains some of the changes to the form, however these changes do not alter any requirements found in the 4000.1.

On Purchase files, TBD will be the default setting in the subject property address field. When you are ready to add the Subject Property Address, make sure the ECD is also updated for the data to save. You can find the ECD on Borrower Summary – 2021. (If you do not enter an ECD, the address will revert to TBD.)

The Origination Compliance Department needs loans due for initials and rate locks to be requested for disclosures in a timely manner, so going forward we are making the following procedural changes as a due date is approaching:

If you missed the Chenoa Sales Training on 3/10, you can access the recording by clicking here (use Access Passcode: Chenoa1!). Please feel free to reach out to our Chenoa rep Cari Zwick with any questions about the program at 630-301-2222. Or you can click this link to schedule a follow-up meeting with her: Cari’s Meeting Link. Attached find Secondary’s memo regarding Chenoa locks and pricing, and a job aid for setting up subordinate financing.

DU “Underwriting Checklist Errors” and LP “Partner Errors” can be double-clicked to see additional information about the error. Attached you’ll find a helpful hints PDF that also compiles the job aids that have been sent out. All URLA guides created by the URLA Team have been uploaded at urla.askvandyk.com (if you need access to AskVanDyk, email Production Support). Please continue emailing URLATeam@vandykmortgage.com with your questions!

Bond Loan Rushes

As a reminder, we cannot close bond loans as a rush.

Bond Cutoff is 10am EST 48 hours prior to the ECD.

Compliance Reminders

Fee overrides should be used sparingly. If your Branch’s fee rules are producing the desired fees, please reach out to Ryan VanDyk (rvandyk@vandykmortgage.com) for assistance.

Click "Start Challenge" to begin!

(wait a moment for the newsletter to load – or scroll down to download!)

Topics in the Announcement

As of 12:01AM on Saturday, Feb 27, 2021, all new loans in Encompass will be started on the 2020 URLA form. Beginning with disclosures 3/1/21 or after, loans must be disclosed using the new form, and AUS will need re-run with the new application format. If you need assistance toggling to the 2020 URLA form please make sure you reach out to URLATeam@vandykmortgage.com for assistance.

Chenoa Fund is a down payment assistance program whose mission is to increase nationwide affordable and sustainable homeownership, with a focus on creditworthy, low and moderate-income individuals. Pricing for Chenoa will be available on March 2, 2021. They offer three FHA programs along with FannieMae HomeReady and standard FannieMae Conventional. A minimum credit score of 640 is required for all programs. Sales training will be scheduled for the first week of March. Their most recent Lending Guide is attached and information is also available at Chenoa Fund Down Payment Assistance Programs https://Chenoafund.org

Effective with loan applications taken on or after March 1, 2021, Renovation Loans will only be available through one of our Broker Partners. Currently offering Renovation Lending is AFR www.afrwholesale.com , Plaza Home Mortgage www.plazahomemortgage.com and Michigan Mutual https://Michiganmutual.com .

Attached please find FHA’s dual purpose condo questionnaire. This questionnaire replaces the questionnaire currently being used for units in projects currently approved by FHA. For FHA approved projects, only Section 3 needs to be completed. For FHA Single-Unit approvals, the entire form must be completed. HUD-9991 Condo LL-SUA Questionnaire 1_30_2020.fillable

Our Citizenship Guidelines have been revised to reflect FHA is now also an acceptable source of financing for individuals accepted under the Deferred Action for Childhood Arrivals program (DACA). Citizenship Policy February 18, 2021

Thank you to everyone inquiring about the status of the jumbo loan product as well as for leads on investors. We are very excited about a new hire starting in March who comes with non-conforming experience and once he is up and running with VDM and our systems, and trained on the investors and guidelines, we will announce the rollout of the new product. Our target date for announcing the new product will be with the April Lending Announcement – stay tuned for further details!

The following fees are now governed by our new DDM Rules:

Branch Fees – Rule active through Closing

If a credit is need on branch fees, please request a lender credit be added rather than having the fee removed. If your fees are incorrect, or you have a special circumstance, please contact Ryan Vandyk (rvandyk@vandykmortgage.com) for assistance.

Appraisal Fees – Rule active until Initial Disclosures are sent.

**Please Note: The Appraisal Waiver Received? field (on LE page 0 & Borrower Summary – 2021) will override the appraisal fee rules when marked YES and allow fees to be removed and not re-populate upon save.

Other Lender Fees – Rules active until Initial Disclosures are sent.

Reminder – These rules fire upon SAVE. These fees will remain editable by all parties but will revert back to their original value upon save if the rule is active. Please be sure to double check any fee changes after you have saved your file to prevent any issues, especially if you have not saved prior to exiting a file.

If your fees are incorrect or you have a special circumstance, please contact Ryan VanDyk (rvandyk@vandykmortgage.com) for assistance.

As a Reminder: For Primary Refinances, all non-borrowing spouses and/or any non-borrowing party with ownership interest in the property (with the right to rescind) needs to sign the initials CD 3 days prior to closing as well as any redisclosed CDs prior to closing. This procedure only applies to rescindable refinances.

We have added automatic reminder emails to be sent on files that could potentially have a non-borrowing party on the loan. If you receive one of these reminders, please verify if your file will have an NBP/NBS and if needed provide their name, email, and eConsent (if eSigning) as early as possible to prevent any delays in disclosure.

Please also be sure to review your Title Reports as soon as they are available to identify any additional parties listed on title that may fall under this rule as well.

Below is how the NBS contact information should look inside of the file contacts for them to receive a CD when the borrower does. Only the highlighted data is required. Their DocuSign link will be sent to them in a separate email, even if they share the same email address as the borrower, please make sure the NBS is aware this will be coming to them.

Effective for Mortgages with Settlement Dates on or after April 1, 2021 – Properties with 2-4 units have a maximum LTV of 85%. Revised Matrix is attached. Freddie Mac Home Possible February 2021

On Friday, February 26, 2021, the existing Guaranteed Underwriting System (GUS) is permanently retiring. The URLA changes and “New GUS” will become effective March 1, 2021. The current and new versions of GUS will not be in service simultaneously, it is essential to understand the processes and procedures involved throughout this changeover.

The most important takeaway is that your USDA loans will need resubmitted to New Gus on/after March 1 if a Conditional Commitment had not yet been issued by the Feb 26, 2021 deadline put in place by RD. If your loan was disclosed on the 2009 URLA it will need to be manually entered into the “New GUS” system, whereas loans originated on the 2020 URLA may be exported from Encompass and uploaded to “New GUS” much like before. This will have to be completed by the LO/TC/LP regardless of where the loan was at in the process if a Conditional Commitment was not issued by 2/26, and New GUS findings will need to be resubmitted to Underwriting so loans may be submitted to RD for a Conditional Commitment

Please contact Production Support if you have any questions. USDA NEW GUS HB-1-3555, Chapter 9

(wait a moment for the newsletter to load – or scroll down to download!)